When Wall Street Bought the Dip: How Ethereum Foundation, BlackRock, and Coinbase Are Quietly Reshaping Crypto's Future

While retail investors panic-sold at the lowest fear levels since 2018, institutions deployed over $200 million in a single week. Here's what they're seeing that you're not.

The Panic Nobody's Talking About

Last week, something remarkable happened in crypto markets—and almost nobody noticed.

The Fear & Greed Index, a widely-watched sentiment gauge, plummeted to 10. To put that in perspective, it hadn't been this low since December 2018, when Bitcoin was trading at $3,200 and most people had written off the entire industry as dead.

Retail investors responded predictably. They sold. Hard. Long-term Ethereum holders dumped 45,000 ETH per day—the highest rate since February 2021. The panic was palpable. Social media was flooded with "crypto is dead" takes. Again.

But here's what makes this moment different: While regular investors were rushing for the exits, the biggest players in finance were doing the exact opposite.

They were buying.

The Great Divergence

In the span of just 48 hours, newly-created whale wallets accumulated over $72 million worth of assets. Bitmine, a lesser-known but increasingly significant institutional player, added $174 million in Ethereum to their holdings—even as their existing position showed a 31.7% paper loss.

Think about that for a moment. A firm sitting on $4.5 billion in unrealized losses decided that this was the moment to buy more.

This isn't irrational behavior. It's a tell.

The number of "whale addresses"—wallets holding more than 1,000 Bitcoin—climbed to 1,384, the highest in four months. Meanwhile, 630,000 Bitcoin quietly left exchanges, suggesting these buyers aren't planning to sell anytime soon.

When Mt. Gox, the infamous exchange that collapsed in 2014 and has been slowly distributing recovered funds, moved 10,422 Bitcoin for the first time in eight months, the market barely flinched. A year ago, that headline alone would have triggered a 10% crash. This time? A mere 2% dip.

The "marginal seller"—the last person willing to dump at any price—appears to be exhausted.

Ethereum Foundation Makes a Historic Bet on Privacy

While price action dominated headlines, something far more significant happened in the background.

For the first time in its history, the Ethereum Foundation—the nonprofit that stewards the world's second-largest blockchain—publicly staked tokens in a privacy protocol called RAIL.

This might sound like inside baseball, but it's not. It's a paradigm shift.

For years, privacy in crypto has been synonymous with illicit activity. Regulators worldwide have cracked down on "mixing" services that obscure transaction trails. The most famous example, Tornado Cash, saw its developers arrested and the protocol sanctioned by the U.S. Treasury.

But the Ethereum Foundation's move signals a different future—one where privacy isn't about hiding criminal activity, but about giving legitimate users control over their own financial data.

Around the same time, Vitalik Buterin, Ethereum's co-founder, publicly demonstrated a new framework called "Kohaku." Unlike old-school privacy tools that hide everything, Kohaku enables "selective disclosure." Users can prove their funds aren't from illicit sources without revealing their entire transaction history.

It's the difference between a locked diary and a security clearance. One hides everything; the other proves you're trustworthy while protecting your privacy.

This matters because institutional money has been waiting on the sidelines for exactly this kind of solution. Banks and asset managers can't use tools that might inadvertently process dirty money. But they also don't want their trading strategies visible to competitors.

Kohaku—and the Ethereum Foundation's endorsement of privacy infrastructure—offers a middle path.

The market noticed. Cypherpunk Holdings, a publicly-traded company on the NASDAQ, disclosed an $18 million purchase of ZEC (Zcash) through traditional financial channels. The Winklevoss twins, who run the Gemini exchange, reportedly increased their privacy asset exposure significantly.

Privacy, it seems, is going mainstream—but not in the way regulators feared.

The AI Payment War Is Already Over

Here's a question that will matter more than most people realize: When AI agents start buying services from other AI agents, how will they pay each other?

If that sounds like science fiction, you're about two years behind.

A protocol called x402 has quietly become the answer. Named after HTTP status code 402 ("Payment Required"), it allows AI systems to pay for API calls, compute resources, and data access in real-time using stablecoins.

The numbers are staggering. In just two weeks, x402 achieved what traditional payment protocols took two years to accomplish. Daily transaction volume stabilized at 720,000 calls. Cloudflare, the company that handles something like 20% of global internet traffic, integrated the protocol. Coinbase built their Agent SDK around it.

Between them, these two companies now control 88% of x402 traffic.

The "standard war" is effectively over before most people knew it was happening.

This matters because AI agents are increasingly autonomous. They're booking travel, managing supply chains, trading securities, and negotiating contracts. They need payment rails that work at machine speed, with machine precision, at machine scale.

Credit cards don't cut it. Bank wires are laughably slow. Even existing crypto payment solutions require too much human oversight.

x402 is purpose-built for a world where software pays software. And whoever controls that infrastructure controls the economic plumbing of the AI age.

Coinbase's new "token sale platform" takes this a step further. Unlike traditional crypto launches that reward insiders and early speculators, Coinbase's system uses algorithmic allocation to prevent whales from cornering supply. There's a six-month lockup to discourage flipping. And perhaps most remarkably, projects must provide IPO-level disclosure—financial statements, team backgrounds, risk factors—before listing.

It's the first serious attempt to bring securities-law-grade investor protection to crypto issuance. If it works, it could become the template every major exchange copies.

BlackRock's Quiet Migration

Meanwhile, the world's largest asset manager is voting with its feet.

BlackRock has begun moving some of its tokenized real-world assets (RWAs)—think Treasury bills and money market funds represented on a blockchain—from Ethereum to Solana.

The reason isn't ideological. It's economic. Solana's transaction fees are roughly 60% lower than Ethereum's base layer.

For institutional-scale operations moving billions of dollars, that difference adds up fast.

This is part of a broader trend. Circle, the company behind USDC (the second-largest stablecoin), launched a testing network called Arc with over 100 institutional partners. Ondo Finance, which specializes in tokenized securities, now manages over $1.8 billion in assets.

The narrative around RWAs has shifted. It's no longer about whether traditional finance will move on-chain, but which chains will capture that flow.

The answer increasingly looks like: whichever ones offer the lowest fees and the clearest regulatory path.

The Coming DeFi Revenue Revolution

For years, decentralized finance protocols gave away their product. They paid users to deposit funds, trade on their platforms, and provide liquidity. The business model was simple: acquire users now, figure out monetization later.

That era is ending.

Uniswap, the largest decentralized exchange, is holding a governance vote on December 2nd that could change everything. The proposal: activate a "fee switch" that would direct a portion of trading fees to token holders.

If it passes, Uniswap would become one of the first major DeFi protocols to share revenue with its community.

The implications extend far beyond one protocol. Aerodrome, a newer exchange, already generates $180 million in annual revenue. Hyperliquid, a derivatives platform, is on pace for $1.7 billion. These aren't theoretical numbers. They're auditable, on-chain cash flows.

For years, crypto valuations were based on "narrative"—the story a project told about its potential. Now, for the first time, there's enough real revenue to value these protocols like actual businesses.

The catch? If protocols start distributing revenue to token holders, regulators might classify those tokens as securities. That's a legal minefield that could take years to navigate.

But the genie is out of the bottle. DeFi has proven it can generate real income. The only question is how that income gets distributed—and to whom.

What Happens Next

The next four weeks will determine whether this week's institutional buying was brilliant or premature.

Three dates matter:

November 24: Monad, a highly-anticipated new blockchain, launches its mainnet. With $225 million in funding and 28x oversubscribed token sale, it's either a validation of continued institutional appetite or a warning sign of frothy valuations.

December 2: Uniswap's fee switch vote closes. A successful vote could catalyze a "revenue revolution" across DeFi. A failed vote would suggest the industry isn't ready to grow up.

December 18: The Federal Reserve announces its final interest rate decision of the year. For all of crypto's claims to operate independently of traditional finance, rate decisions still move markets. A dovish surprise could trigger a rally; a hawkish one could extend the pain.

For now, the setup is clear: retail is panicking, institutions are accumulating, and the infrastructure for the next cycle is being built in plain sight.

The last time this happened was late 2018. What followed was the most spectacular bull market in crypto history.

History doesn't repeat, but it does rhyme.

The Bottom Line

If you've made it this far, you're probably not the average retail investor who panic-sold last week. Good.

Here's what the smart money is doing:

- Keeping powder dry: 40-50% in stablecoins, ready to deploy when the bottom is confirmed

- Watching the institutional cost basis: $82,000-84,000 for Bitcoin, $2,800-3,200 for Ethereum

- Positioning for structural shifts: Privacy infrastructure, AI payment rails, RWA settlement layers

- Ignoring the noise: Fear indexes, social media sentiment, and daily price action are distractions

The real signal is on-chain: who's buying, how much, and where they're putting it.

Right now, that signal says: the biggest players in finance think crypto's future is brighter than its present.

Whether you agree depends on whether you trust Wall Street's judgment—or your Twitter timeline.

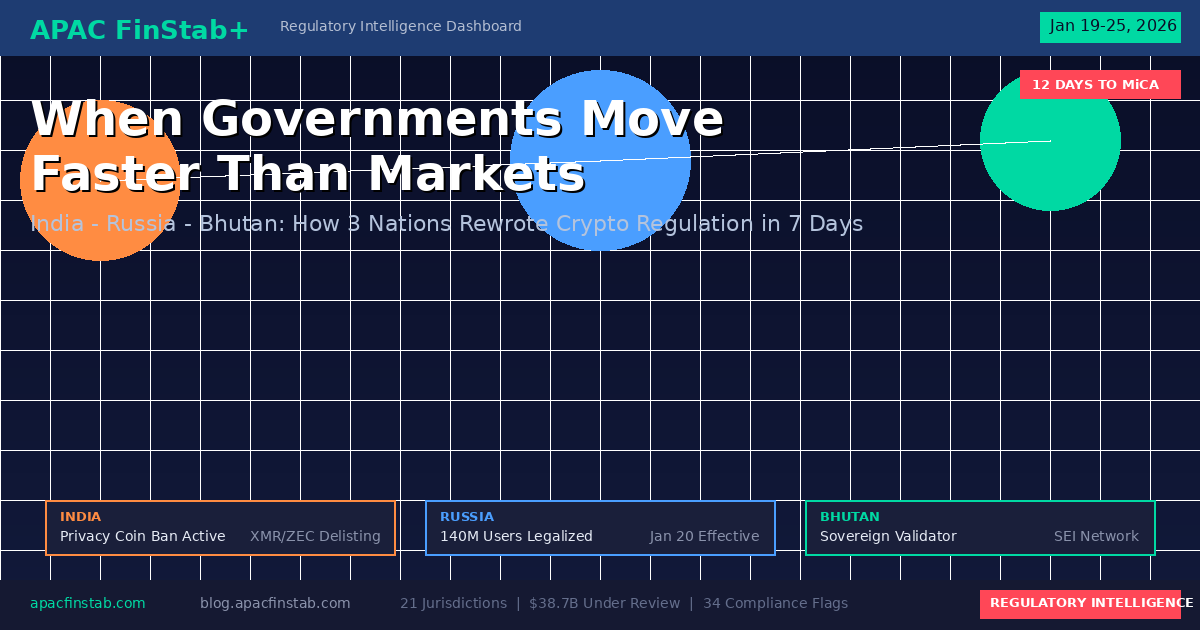

This analysis is part of APAC FinStab+'s weekly intelligence briefing. For institutional-grade crypto market analysis, regulatory monitoring, and actionable insights, visit apacfinstab.com or subscribe to our research at blog.apacfinstab.com.

About APAC FinStab+

APAC FinStab+ provides institutional-grade regulatory intelligence and market analysis for the Asia-Pacific financial technology sector. Our weekly briefings synthesize cross-jurisdictional policy developments, on-chain analytics, and institutional flow data for professional investors, exchange executives, and compliance officers.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency markets are highly volatile and speculative. Past performance does not guarantee future results.

Tags: #Crypto #Ethereum #Bitcoin #BlackRock #Coinbase #DeFi #Privacy #AI #Blockchain #Investing #Finance #Web3