When the SEC and CFTC Stopped Fighting Over Crypto — And What It Means for Your Money in Asia

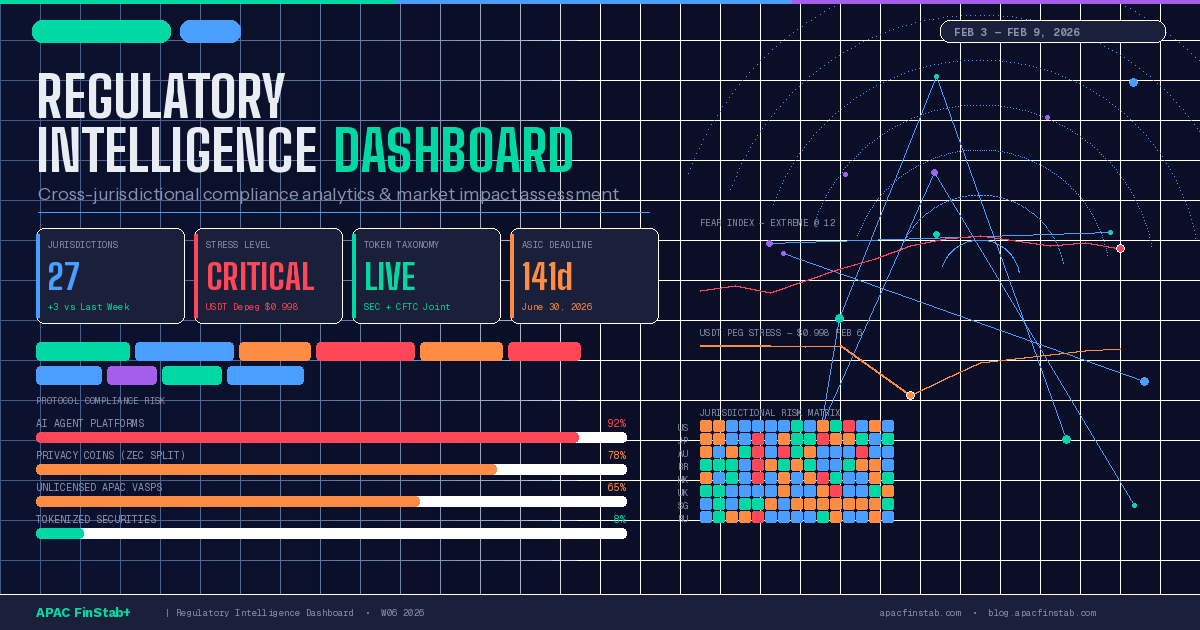

How Project Crypto, the USDT depeg crisis, and Australia's licensing countdown are quietly redrawing the rules of global finance — while most people aren't paying attention.

For the better part of a decade, two of America's most powerful financial regulators have been locked in a turf war over cryptocurrency. The SEC said most tokens were securities. The CFTC said they were commodities. Crypto companies, caught in the crossfire, either spent millions on lawyers or simply left the country.

On January 30th, that war ended.

SEC Chair Paul Atkins and CFTC Chair Michael Selig stood together at CFTC headquarters in Washington and announced that "Project Crypto" — previously an SEC-only initiative — would now be a joint operation. More importantly, they agreed on something that would have been unthinkable two years ago: "Most crypto assets trading today are not securities."

That single sentence will reshape hundreds of billions of dollars in capital flows. And if you think this only matters to people who own Bitcoin, you're not paying attention.

The Taxonomy That Will Sort Winners from Losers

Here's what actually happened beneath the diplomatic language: the two agencies announced they will create a binding "token taxonomy" — a classification system that will place every crypto asset into one of four buckets:

Digital commodities (like Bitcoin). Digital collectibles (like NFTs). Tools (utility tokens that power specific platforms). And tokenized securities (stocks, bonds, and real estate recorded on blockchain).

The first three categories? Not securities. No SEC registration required. Full institutional access — meaning your pension fund, your bank, and your brokerage can touch them without legal risk.

The fourth category — tokenized securities — gets the same treatment as traditional stocks and bonds. Same rules, same protections. The SEC's three divisions issued joint guidance on January 28th confirming this, and the Depository Trust Company — the backbone of American stock trading — received a no-action letter to begin tokenizing Russell 1000 stocks and U.S. Treasuries.

Read that again: the organization that settles trillions of dollars in stock trades every year is now putting those assets on blockchain. Not in a lab. Not in a pilot. In production.

But here's where it gets uncomfortable. Not every asset lands neatly in a friendly bucket. The taxonomy includes a fifth, unofficial category that insiders are calling "divergent" — assets that don't clearly fit anywhere. Aptos, a blockchain with 5.2 million daily transactions and a partnership with BlackRock, received this classification. Being "divergent" means uncertain custody rules, no ETF pathway, and institutional investors steering clear until the ambiguity resolves.

For the crypto industry, this taxonomy is the most consequential regulatory event of 2026. For everyone else, it's something more fundamental: the moment when the world's largest financial market decided that digital assets aren't going away, and started writing the rules to make them permanent.

The Night Tether Broke Its Promise

While Washington was drawing neat lines on paper, the market was conducting its own stress test.

On February 6th, as Bitcoin plunged 14% in a single day and $1.25 billion in leveraged positions evaporated within hours, something happened that hadn't occurred in five years: USDT — the world's most-used stablecoin, the one that processes more daily volume than Visa — briefly broke its peg to the U.S. dollar.

It dropped to $0.998.

Two-tenths of a cent doesn't sound like much. But USDT underpins roughly $130 billion in global crypto trading infrastructure. A two-tenths-of-a-cent deviation, sustained for even a few hours, means billions of dollars in transactions settled at incorrect prices. It means margin calls that shouldn't have been triggered. It means arbitrage bots pulling liquidity from exchanges in emerging markets where that liquidity may not return quickly.

For regulators, the timing couldn't have been more pointed. The Financial Action Task Force — the global body that sets anti-money-laundering standards — is conducting its early-2026 review of stablecoin risks right now. Japan's Financial Services Agency opened a public consultation on stablecoin reserve rules the week before, with comments due February 27th. Hong Kong's monetary authority, which received over 70 applications for stablecoin licenses, has publicly stated it will approve "no more than a handful."

The depeg gave every one of these regulators exactly what they needed: proof that the largest stablecoin in the world can lose its peg during market stress. Expect tighter reserve requirements, more prescriptive redemption rules, and longer approval timelines across every major Asian financial hub.

Meanwhile, a quieter signal was flashing in the data: USDC — Tether's smaller, more regulated competitor — saw its holder base grow 60% year-over-year. In the emerging "AI agent economy," where autonomous software programs execute financial transactions, USDC achieves 9x monthly turnover compared to USDT's 3x. The market isn't just nervous about Tether. It's actively migrating.

141 Days: Australia's Countdown to Compliance

Twelve thousand kilometers from Washington, Australia's Securities and Investments Commission is running out of patience.

In its "Key Issues Outlook 2026" report, ASIC used language that regulators typically reserve for imminent enforcement: "Rapid growth in unlicensed cryptoasset, payments and artificial intelligence firms has created regulatory gaps that expose consumers to risk."

The translation is simple: get licensed or get shut down.

ASIC's "no-action relief" — a grace period that allowed crypto firms to operate without a full Australian Financial Services License — expires on June 30, 2026. That's 141 days from the publication of this report. After that date, any digital asset business operating in Australia without an AFSL faces enforcement action.

This isn't abstract. Australia has the 13th-largest economy in the world and one of the highest crypto adoption rates in the Asia-Pacific. Hundreds of firms — from small exchanges to major international platforms with Australian users — are now racing to either secure licenses or withdraw from the market entirely.

What makes this particularly interesting is what ASIC did simultaneously: it released an exemption for intermediaries involved in distributing approved stablecoins, reducing the regulatory friction for compliant entrants. The message is crystal clear — we're not anti-crypto, we're anti-unlicensed-crypto. Come through the front door or don't come at all.

The Invisible Regulators: 50+ Countries Now Tracking Your Crypto Taxes

While headline-grabbing events dominate the news cycle, the most consequential regulatory change of 2026 is happening almost entirely out of sight.

On January 1st, the OECD's Crypto-Asset Reporting Framework — known as CARF — began its reporting period across more than 50 jurisdictions. This means that every crypto exchange, wallet provider, and service platform operating in participating countries is now legally required to collect detailed customer information — including transaction histories, account balances, and counterparty details — and report it to tax authorities.

The first data exchanges between governments will happen in 2027. But the collection started this year. If your crypto platform isn't asking you for more identification documents right now, it's either not compliant or not operating in a CARF jurisdiction — and both of those should concern you.

This is the crypto equivalent of FATCA — the Foreign Account Tax Compliance Act that transformed international banking a decade ago. FATCA made it effectively impossible to hide assets in foreign bank accounts. CARF will do the same for crypto. The era of pseudonymous wealth in digital assets is ending, jurisdiction by jurisdiction, with 50+ countries moving in lockstep.

Brazil Just Went from Zero to Fully Regulated — Overnight

On February 2nd, Brazil's Central Bank authorization regime for crypto firms went live. In a single day, the largest cryptocurrency market in Latin America went from having no formal VASP licensing to requiring capital reserves of BRL 10.8 million to BRL 37.2 million (roughly $2 million to $7 million), enhanced reporting for cross-border stablecoin transfers exceeding $100,000, and full AML/CFT compliance.

Existing firms get a 270-day grace period — until October 30, 2026 — to comply. New entrants must be fully licensed from day one.

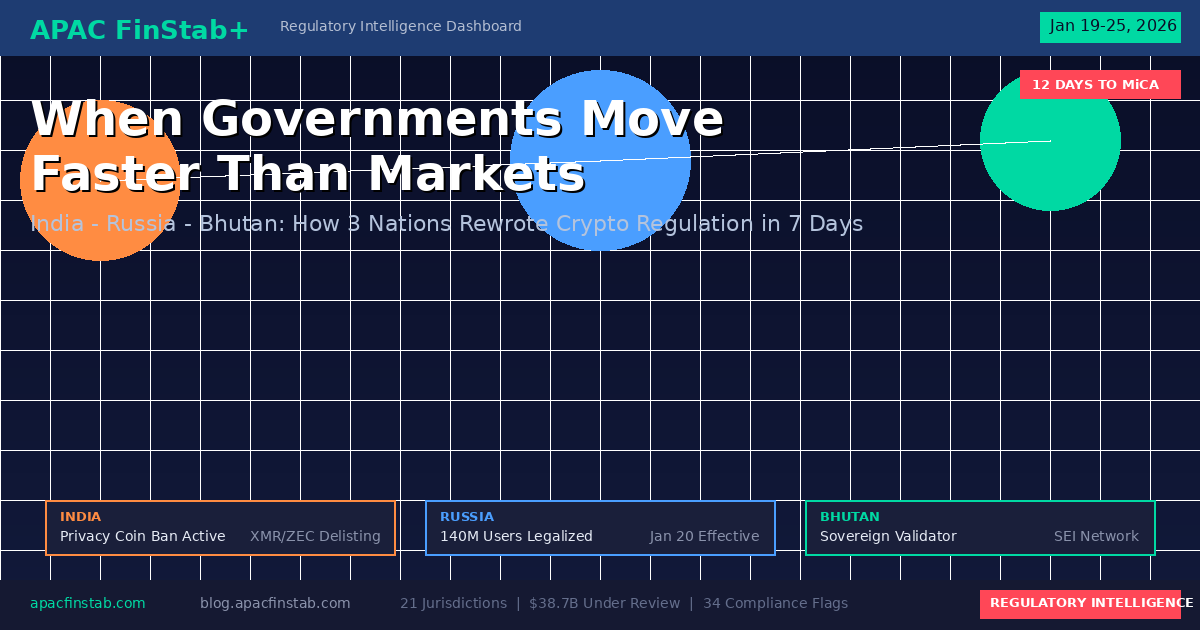

This matters beyond Brazil because it demonstrates the new speed of global crypto regulation. Countries aren't spending years debating frameworks anymore. They're watching what the EU, Singapore, and Hong Kong have done, adapting those models, and implementing them in months. Vietnam's Digital Transaction and Information Law went live on January 1st. The UK's FCA will open its full crypto authorization gateway on September 30th. Russia legalized crypto for all investors this week.

The pattern is unmistakable: 2026 is the year that crypto regulation stops being a debate and becomes an operational reality. The question isn't whether your country will regulate crypto. It's whether you'll be ready when it does.

The Regulatory Black Hole: 10,000 AI Agents With No Rules

And then there's the thing nobody is regulating at all.

Over 10,000 autonomous AI agents are now deployed on Ethereum's ERC-8004 identity standard. These agents don't just analyze data — they execute financial transactions, launch tokens, hire human workers, and process payments through protocols like x402. One platform alone, PumpFun, generates over $10 million per week in revenue from agent-initiated token launches on Solana.

None of this has a regulatory classification in any jurisdiction on earth.

No KYC framework exists for agent-initiated transactions. No liability assignment covers agent failures. The FATF Travel Rule — which requires sender and recipient information for every transaction — applies to human-initiated transfers but has no provision for agent-to-agent commerce. When an AI agent pays another AI agent in USDC for completing a task, whose identity gets reported? Who is liable if the transaction facilitates money laundering?

These aren't hypothetical questions. They're happening thousands of times per day, right now.

This is the single largest unregulated financial activity category in cryptocurrency. It's also the fastest-growing. And unlike previous regulatory blind spots — DeFi lending, privacy coins, stablecoins — there's no existing legal framework that can be extended to cover it. Agent autonomy is fundamentally different from human-directed transactions, and regulators are at least 12-18 months away from even proposing classification frameworks.

For firms building or integrating AI agents, the window to build compliance-ready architectures is open now. It won't stay open long.

What This Means: The Three-Layer World

Step back far enough and a pattern emerges from this week's regulatory developments. The global financial system is reorganizing itself into three distinct layers:

Layer 1: Fully Regulated Digital Assets. Bitcoin, Ethereum, tokenized securities, compliant stablecoins. These now have clear rules, institutional access, and ETF pathways. The SEC's token taxonomy, CFTC's collateral approvals, and DTC's tokenization of Treasuries all point in the same direction — traditional finance is absorbing crypto's most established assets into its existing infrastructure. Compliance risk: minimal. Growth trajectory: institutional.

Layer 2: Regulated but Fragmented. Privacy coins, newer L1 blockchains, cross-border stablecoin transfers. These face different rules in different jurisdictions. Japan banning something that Singapore allows. Australia licensing something that New Zealand ignores. Compliance risk: high and jurisdiction-dependent. Growth trajectory: uncertain.

Layer 3: The Unregulated Frontier. AI agents, autonomous commerce, agent-to-agent payments. No rules exist. No frameworks are close. Revenue is real and growing exponentially. Compliance risk: maximum when regulation arrives. Growth trajectory: explosive — until it isn't.

Every asset, every protocol, every business in the crypto ecosystem is sorting itself into one of these three layers. The taxonomy announced by the SEC and CFTC on January 30th isn't just a classification exercise — it's the first official map of this three-layer world.

The question for every investor, every institution, and every policymaker is the same: which layer are you in, and is that where you want to be when the rules finish being written?

APAC FinStab+ tracks regulatory developments across 27 Asia-Pacific jurisdictions weekly. For the full interactive dashboard with compliance risk scores, jurisdictional heat maps, and actionable intelligence, visit apacfinstab.com. Subscribe to the weekly intelligence brief at blog.apacfinstab.com.