When Tether Split in Two and THORChain Went Broke: The Week That Rewrote Crypto's Rulebook

APAC FinStab+ Weekly Intelligence Brief | January 26 - February 2, 2026

The Week Everything Changed

Something unusual happened in the last week of January 2026. While Bitcoin crashed 40% from its all-time high and $17.4 billion in leveraged positions got liquidated in a single cascade, the most important developments in crypto weren't happening on trading screens. They were happening in boardrooms, regulatory offices, and bank vaults.

This is a story about how the rules of digital finance got rewritten in seven days—and why most people completely missed it.

Part 1: The Day Tether Became Two Companies

On January 27th, something happened that would have been unthinkable just a year ago: Tether, the company behind the world's most controversial stablecoin, launched a new product through a federally-chartered American bank.

Meet USA₮.

Unlike its older sibling USD₮ (the $83 billion stablecoin that powers most of global crypto trading), USA₮ was born inside the American financial system. Issued through Anchorage Digital Bank—one of the only federally-chartered crypto banks in existence—with custody provided by Cantor Fitzgerald, a Wall Street institution that's been around since 1945.

Why does this matter if you're not in crypto?

Because Tether just did what no crypto company has ever successfully done before: it created a bridge between the offshore crypto world and the regulated American financial system. One company, two products, two entirely different regulatory universes.

Think of it like a multinational corporation that operates both a Swiss private bank and an FDIC-insured American savings account. Same parent company, completely different rules.

For Circle, the company behind USDC (Tether's main competitor), this is a nightmare scenario. Circle spent years positioning itself as the "compliant" alternative to Tether. Now Tether has a compliant product too—while keeping its $83 billion offshore business running.

The stablecoin market isn't just bifurcating. It's being rebuilt from the ground up.

Part 2: The First DeFi Bankruptcy Since 2022

While everyone was watching Bitcoin's price, a quiet crisis was unfolding at THORChain, one of the most ambitious projects in decentralized finance.

On January 30th, THORChain did something that DeFi protocols almost never do voluntarily: it admitted it couldn't pay its debts.

The numbers are stark. $200 million in bad loans. A 90-day restructuring plan. The complete suspension of the lending product that was supposed to be the protocol's future.

But here's what makes this story important beyond crypto:

THORChain's lending product was built on a promise that's become common in DeFi: sustainable yields without traditional collateral. Borrow against your crypto, earn yield on the borrowed funds, pay back the loan later. It works beautifully—until it doesn't.

What killed THORChain's lending business was the same thing that kills traditional banks: a mismatch between assets and liabilities. When Bitcoin dropped 40% in a week, borrowers couldn't repay their loans. When borrowers can't repay, lenders can't be paid. When lenders can't be paid, the whole system freezes.

This is the first major DeFi debt crisis since the 2022 collapse that took down Celsius, BlockFi, and Three Arrows Capital. It's a reminder that "decentralized" doesn't mean "immune to financial gravity."

The lesson for anyone watching the intersection of technology and finance: the fundamental rules of lending—collateral, liquidity, duration matching—don't disappear just because you put them on a blockchain.

Part 3: The Regulators Who Couldn't Agree

Here's a puzzle: On January 30th, India banned Zcash (ZEC), a privacy-focused cryptocurrency, citing money laundering concerns. The same week, Binance—the world's largest crypto exchange—listed Zcash on its platform. Gemini, the exchange founded by the Winklevoss twins, launched a Zcash rewards credit card.

Same asset. Same week. Completely opposite regulatory treatment.

Welcome to the era of regulatory arbitrage.

For years, crypto advocates warned that inconsistent regulation would create a patchwork where the same activity is legal in one country and criminal in another. That prediction has now fully materialized.

What makes the Zcash situation particularly striking is how explicit the contradiction has become. This isn't a gray area or a matter of interpretation. India's regulators said "this is illegal" while major global exchanges said "this is a featured product." Both statements are true, depending on where you're standing.

For businesses operating in this environment, the implications are profound. Compliance isn't about following rules anymore—it's about choosing which rules to follow, in which jurisdictions, for which customers.

Part 4: The Meme Coin That Went to Washington

Perhaps the most surprising filing of the week came from Canary Capital, an asset manager that submitted paperwork to the SEC for something that would have been laughable a year ago: a PEPE ETF.

PEPE, for those unfamiliar, is a meme coin. Its entire value proposition is that it features a cartoon frog. There's no technology, no utility, no revenue. Just a frog and a community that thinks the frog is funny.

And now someone wants to put it in a regulated investment vehicle that retirement accounts could theoretically buy.

This isn't a joke. It's a signal.

The ETF pipeline in crypto has followed a clear progression: Bitcoin first (too big to ignore), then Ethereum (has actual utility), then Solana (has even more utility), then NEAR (institutional adoption story). Each step was justified by some fundamental argument about the asset's value.

PEPE breaks that pattern entirely. If regulators approve a PEPE ETF, they're essentially admitting that the line between "legitimate" and "illegitimate" crypto assets is a fiction. Speculation is speculation, whether it's dressed up in technological jargon or cartoon frogs.

The filing probably won't succeed. But the fact that a serious asset manager thought it was worth trying tells you everything about where the regulatory window has moved.

Part 5: The Institutional Counter-Signal

Here's the detail that most people missed amid the chaos of last week:

While retail traders were panic-selling and $978 million was flowing out of Bitcoin ETFs, Binance—the largest crypto exchange in the world—was quietly doing the opposite.

The company announced it would convert $1 billion from its emergency reserve fund (called SAFU) from stablecoins to Bitcoin. Not all at once, but systematically: roughly $33 million per day, over 30 days.

Think about what this means.

Binance sees Bitcoin at $80,000—down 40% from its high—and decides this is the moment to move a billion dollars of their safety net into the asset. This isn't a trading position. This is a statement about what Binance thinks Bitcoin is worth as a long-term store of value.

At the same time, the CFTC (Commodity Futures Trading Commission) approved Ethereum as collateral for derivatives trading. This sounds technical, but it's actually a massive milestone: it means institutional traders can now use ETH the same way they use Treasury bonds or corporate debt—as a foundational asset in complex financial structures.

The message from institutions is clear, even if it contradicts what the price charts are showing: crypto's integration into traditional finance isn't slowing down. It's accelerating.

What Happens Next: The White House Stablecoin Summit

On February 3rd, the most significant crypto policy meeting of 2026 will take place at the White House.

The topic: implementation of the GENIUS Act, the legislation that will define how stablecoins operate in the United States for the next decade.

The timing of Tether's USA₮ launch—just one week before this summit—is almost certainly not a coincidence. Someone at Tether is betting that showing up with a federally-compliant product already in market will be more persuasive than any lobbying effort.

The outcome of this meeting will determine:

- Whether stablecoins need federal charters or can operate under state licenses

- What reserve requirements issuers must maintain

- How cross-border stablecoin transactions will be regulated

- Whether algorithmic stablecoins (the kind that collapsed spectacularly in 2022) will be permitted at all

For anyone trying to understand where digital finance is headed, this summit is required viewing.

The Bottom Line

The week of January 26 - February 2, 2026, will be remembered as the moment crypto's institutional transformation became undeniable.

Not because of price movements—those are always temporary.

But because of structural changes that can't be reversed:

- A stablecoin issuer that now operates on both sides of the regulatory divide

- A DeFi lending crisis that proved the old rules of finance still apply

- A regulatory environment so fragmented that the same asset is simultaneously banned and featured

- An ETF filing that suggests even meme coins might get institutional wrappers

- An institutional class that's buying while retail is selling

The future of digital finance isn't being built in the places most people are looking. It's being built in bank charters, regulatory filings, and policy summits.

Those who understand this will be positioned for what comes next. Those who don't will be surprised when it arrives.

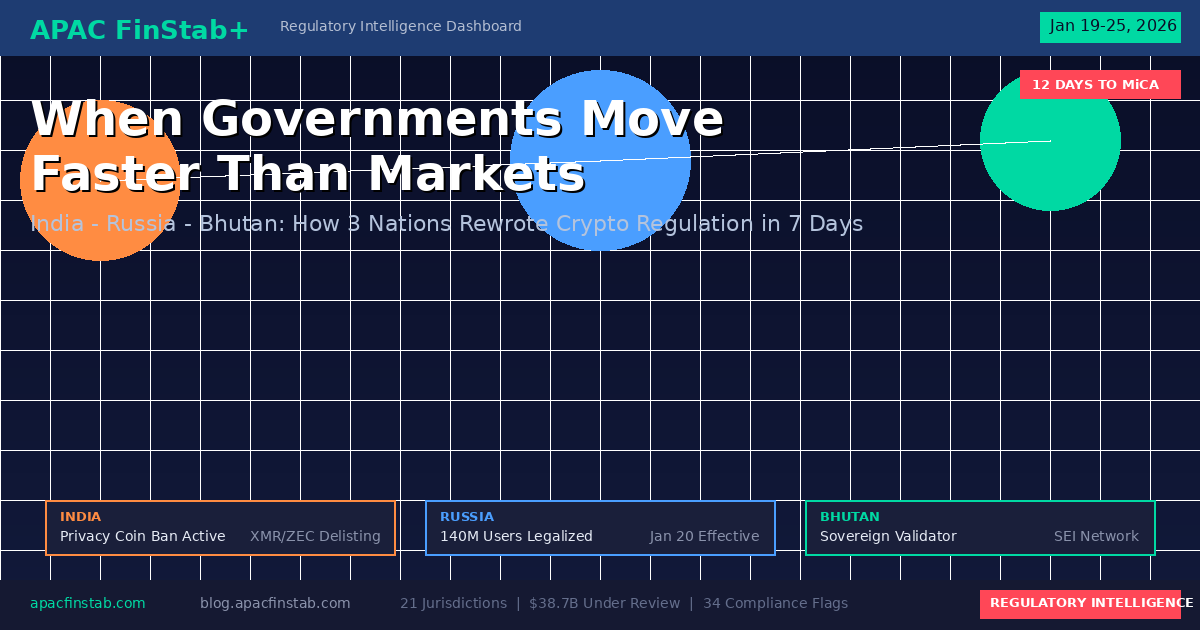

This analysis is part of APAC FinStab+'s weekly regulatory intelligence service. For real-time updates on regulatory developments across 24 jurisdictions, visit the full dashboard at apacfinstab.com.

Subscribe to our weekly intelligence brief at blog.apacfinstab.com to receive analysis like this directly in your inbox.