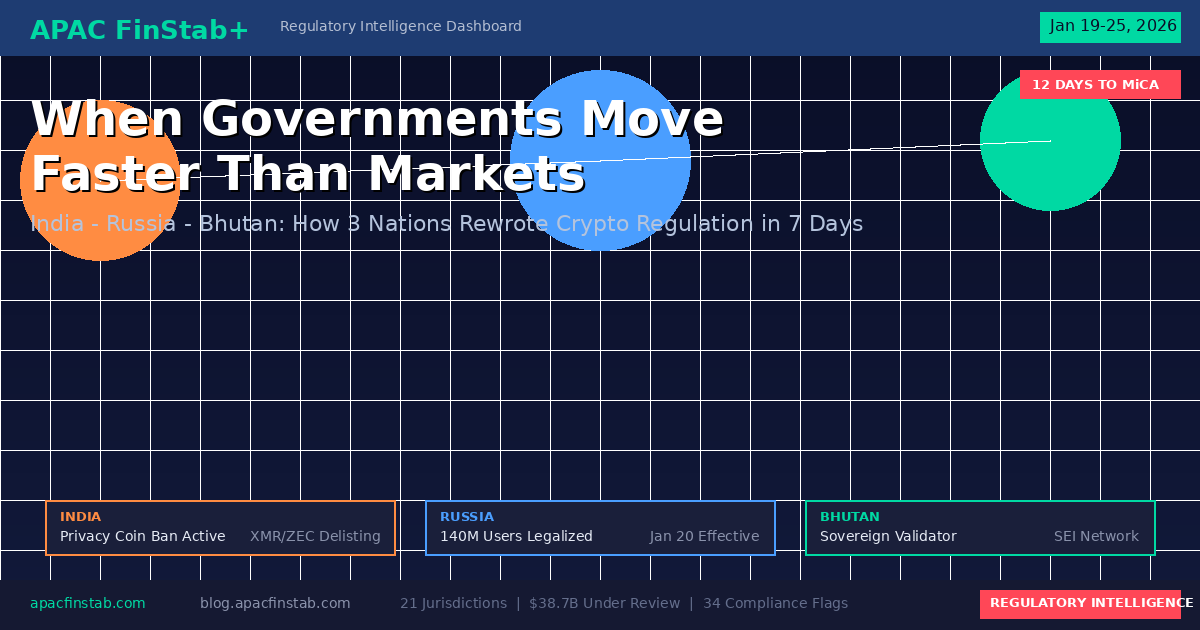

When Governments Move Faster Than Markets: How India, Russia, and a Tiny Himalayan Kingdom Rewrote Crypto Rules in 7 Days

The 7-Day Regulatory Earthquake

Something remarkable happened between January 19 and January 25, 2026. In just seven days, three nations on three different continents made decisions that will reshape how billions of people interact with digital money.

Russia legalized cryptocurrency for 140 million citizens. India banned privacy-focused digital currencies. And Bhutan—a Buddhist kingdom of 780,000 people nestled in the Himalayas—became the first sovereign nation to officially validate a blockchain network.

These aren't isolated events. They're connected chapters in a story about how governments are racing to control (or embrace) a technology that doesn't respect borders.

If you work in finance, compliance, or simply hold any cryptocurrency, this week's events have direct implications for your money.

Chapter 1: The Indian Crackdown Nobody Saw Coming

On January 23rd, Indian financial regulators issued delisting orders for Monero and Zcash—two cryptocurrencies designed to keep transactions private.

This wasn't a surprise to everyone. Dubai had banned Monero just eight days earlier, moving with unprecedented speed—within 18 hours of the coin reaching its all-time high price of $797.

But India's move signals something bigger: coordinated enforcement across Asia.

Here's what most people miss: When Dubai banned Monero on January 15th, it wasn't just Dubai making a decision. It was a signal. Intelligence sharing between financial regulators across the UAE, India, Singapore, and Hong Kong has accelerated dramatically since 2024.

When one domino falls, others follow within days—not months.

For the average person, this means privacy-focused cryptocurrencies are becoming radioactive across Asia. If you hold these assets through any exchange accessible to Asian residents, your access could disappear without warning.

Chapter 2: Russia Opens the Floodgates

While Asia tightened restrictions, Russia did the opposite.

On January 20th, Russia formally legalized cryptocurrency ownership and trading for its 140 million citizens. This isn't just about Russians buying Bitcoin. It's about a major economy creating a parallel financial system outside Western control.

The strategic calculation is clear: As Western sanctions continue, Russia needs alternative payment rails. Cryptocurrency provides exactly that—a way to move value across borders without touching the SWIFT banking network.

For global markets, this creates a fascinating tension. The same week that India cracked down on financial privacy, Russia embraced it. The same technology. Completely opposite regulatory responses.

This divergence will define the next decade of global finance.

Chapter 3: The Himalayan Kingdom That Outsmarted Everyone

The most surprising news came from the smallest player.

Bhutan's sovereign wealth fund—the investment vehicle for an entire nation—became an official validator on the SEI blockchain network. Meanwhile, Korea University, one of Asia's most prestigious academic institutions, became a validator on the Injective network.

Why does this matter?

A validator is essentially a referee for a blockchain network. They verify transactions and maintain the system's integrity. When a sovereign wealth fund takes on this role, it's not just an investment—it's an endorsement of the technology itself.

Bhutan isn't buying cryptocurrency. Bhutan is operating cryptocurrency infrastructure.

This is the equivalent of a nation not just buying shares in a railroad company, but actually running the trains.

For institutional investors watching from the sidelines, this changes the risk calculus entirely. If a sovereign nation is willing to stake its reputation on blockchain infrastructure, perhaps the technology is more mature than skeptics believe.

Chapter 4: The 12-Day Countdown

While these dramatic moves grabbed headlines, a quieter deadline approaches.

In 12 days, the European Union's Markets in Crypto-Assets (MiCA) regulation enters full enforcement. This is the most comprehensive cryptocurrency regulatory framework ever implemented by a major economy.

What MiCA means for you:

If you hold stablecoins (digital currencies pegged to traditional currencies like the US dollar), your access may change. Stablecoins without EU authorization will be delisted from platforms serving European customers.

The largest stablecoin, USDT (Tether), has uncertain MiCA compliance status. USDC (from Circle) has confirmed compliance. The difference could mean billions of dollars moving between platforms in the coming days.

For Americans, this might seem distant. But European regulations often preview what's coming elsewhere. When Europe creates compliance frameworks, global platforms typically adopt them worldwide—it's cheaper than maintaining separate systems for each market.

Chapter 5: The $4 Billion Single Point of Failure

Amid the regulatory drama, a technical vulnerability emerged that should concern everyone in the industry.

Hyperliquid, a popular derivatives trading platform, currently holds $4 billion in USDC stablecoin on a single bridge to the Arbitrum network.

Translation for non-technical readers: Imagine a bank that keeps all its deposits in one vault, with one key, in one building. That's essentially Hyperliquid's current architecture.

This concentration risk isn't illegal. It's not even unusual in the cryptocurrency industry. But it represents exactly the kind of systemic vulnerability that regulators worry about.

The platform's token has already dropped 56% from its peak as sophisticated investors recognize the risk.

Chapter 6: The ETF Pipeline Expands

For those seeking regulated exposure to cryptocurrency, January 2026 brought good news.

Bitwise Asset Management filed for a NEAR ETF, making it the fourth Layer-1 blockchain to enter the institutional pipeline after Bitcoin, Ethereum, and Solana. Grayscale launched a trust product for TAO, a decentralized artificial intelligence network.

What this means: The walls between traditional finance and cryptocurrency are becoming more porous. Each new ETF or trust product creates another doorway for pension funds, endowments, and retirement accounts to access digital assets.

The SEC Chair's confirmed attendance at the ONDO Summit on February 3rd—alongside executives from BlackRock, JPMorgan, and Goldman Sachs—suggests this trend will accelerate.

What Should You Actually Do?

Based on this week's developments, here are concrete actions for different audiences:

If you hold privacy coins (Monero, Zcash, etc.): Consider your exit strategy now. The delisting cascade is accelerating across Asia, and MiCA enforcement will extend it to Europe. Access windows are closing.

If you hold stablecoins: Verify your stablecoin's MiCA compliance status. USDC is confirmed compliant. USDT's status remains uncertain. Ripple's RLUSD and PayPal's PYUSD are now available through Interactive Brokers for those seeking traditional brokerage access.

If you're an institutional investor: The sovereign and academic validator trend (Bhutan, Korea University) signals a maturation of blockchain infrastructure. Due diligence frameworks should account for this legitimization signal.

If you're a compliance officer: The 7-day response time between Dubai's Monero ban and India's crackdown suggests coordinated APAC enforcement. Monitor announcements from one jurisdiction as leading indicators for others.

The Bigger Picture

January 19-25, 2026 will be remembered as the week when cryptocurrency regulation stopped being theoretical and became visceral.

Nations are no longer asking whether to regulate digital assets. They're asking how—and their answers reveal fundamental disagreements about privacy, sovereignty, and the future of money.

Russia sees cryptocurrency as an escape valve from Western financial control. India sees privacy coins as a threat to financial surveillance. Bhutan sees blockchain infrastructure as a national asset. Europe sees comprehensive regulation as the price of market access.

These aren't just policy preferences. They're competing visions for the future of global finance.

The winners will be those who position themselves at the intersection of institutional legitimacy and technological innovation. The losers will be those who bet on regulatory arbitrage—assuming they can outrun governments that have learned to move fast.

This week proved that assumption is no longer safe.

For real-time regulatory intelligence and weekly analysis, visit the APAC FinStab+ dashboard at apacfinstab.com

Subscribe to our intelligence briefings at blog.apacfinstab.com