When Goldman Sachs and JPMorgan Run the Same Blockchain Network — And Nobody Noticed: Canton, XMR, and the Week Crypto Split in Two|APAC FinStab+ Weekly Intelligence Blog Post Week of January 13-19, 2026

The $300 Billion Secret Hiding in Plain Sight

Here's something that should be on the front page of every financial newspaper but isn't: Goldman Sachs, JPMorgan, and BNP Paribas are running validator nodes on the same blockchain network. Together. Right now.

The network is called Canton. It processed $300 billion in institutional settlements on a single day last week. That's not a typo. Three hundred billion dollars. Daily.

For context, that's roughly equivalent to the entire market capitalization of the cryptocurrency industry in 2020 — moving through a single network, every single day.

But here's the twist that makes this story fascinating: while these banking giants are quietly building the future of institutional finance on blockchain rails, JPMorgan's CFO Jeremy Barnum stood up on January 14th and called interest-bearing stablecoins "clearly dangerous and unwelcome."

Welcome to the week crypto split in two.

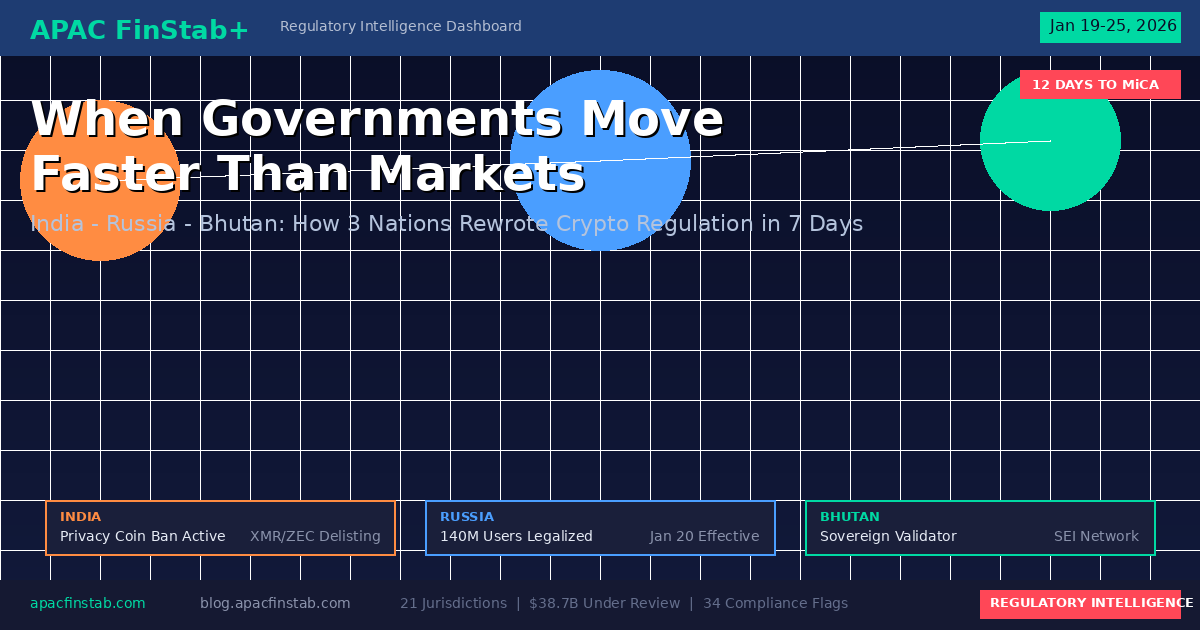

The Privacy Paradox: When Regulations Move Faster Than Markets

On January 15th, Monero (XMR) — the cryptocurrency famous for making transactions untraceable — hit an all-time high of $797. The celebration lasted exactly 18 hours.

Within that window, Dubai's financial regulators issued a ban on XMR trading. HTX, a major exchange, suspended deposits. And suddenly, the narrative flipped from "privacy coins are going mainstream" to "privacy coins are getting blacklisted across APAC."

The 18-hour regulatory response time is unprecedented. In previous cycles, regulators took months or years to respond to market developments. Now they're moving in hours.

This isn't just about Monero. The entire Zcash development team resigned on January 7th over internal disputes. Privacy-focused protocols are facing an existential moment: regulators have decided that complete anonymity is incompatible with the financial system they're willing to tolerate.

But here's what makes this genuinely interesting — at the exact same time Dubai was banning anonymous transactions, those same regulators were cheering Canton Network, where Goldman Sachs can selectively disclose transaction details to auditors without revealing them to competitors.

The future isn't "privacy vs. no privacy." It's "auditable privacy for institutions vs. no privacy for everyone else."

The Day Twitter Killed an Entire Crypto Sector

On January 15th, Nikita Bier — X's Product Lead — announced a policy change that sounds boring but destroyed billions in market value: apps that reward users for posting on X would lose API access.

This single announcement collapsed what the crypto industry calls "InfoFi" — protocols like Kaito, Cookie, XEET, and Pulse that paid users cryptocurrency for their social media activity.

Kaito shut down its Yaps business. Cookie closed its Snaps platform. XEET and Pulse entered "maintenance mode" — the crypto euphemism for "we're figuring out if we have a business anymore."

The lesson here isn't about crypto. It's about platform risk.

These protocols built their entire business models on access to Twitter's API. They assumed that access was a feature, not a privilege. When the platform changed its mind, their businesses evaporated overnight.

For anyone building on top of social media platforms — crypto or otherwise — this is the cautionary tale of 2026.

The Robot Economy Nobody's Pricing In

While everyone was watching Bitcoin ETF flows and privacy coin drama, something genuinely weird happened: a cluster of protocols focused on "robot payments" started gaining traction.

PEAQ, a $55 million market cap project, is building what it calls a "Machine DePIN L1" — essentially, a blockchain designed for robots to pay each other. KONNEX is creating smart contracts that robots can sign autonomously. GEODNET has built the world's largest centimeter-level positioning network.

This sounds like science fiction, but the use case is already here. When your Tesla needs to pay for charging, or your delivery drone needs to pay for landing rights, or your robotic vacuum needs to pay for updated floor maps — where does that transaction happen?

Right now, these payments route through human-controlled bank accounts with human-readable statements. But robots don't have Social Security numbers. They can't open bank accounts. They can't sign contracts.

The robotics industry is projected to hit $100 billion by 2027. The crypto market has barely begun pricing in the infrastructure those robots will need to participate in the economy.

Morgan Stanley Says Solana Is Ready for Wall Street

On January 16th, Morgan Stanley filed for a Solana ETF with the SEC.

This matters because Morgan Stanley isn't a crypto company. They're not a hedge fund betting on speculation. They're a 90-year-old Wall Street institution with $1.2 trillion in client assets under management.

When Goldman buys Bitcoin, that's news. When Morgan Stanley files for a Solana ETF, that's a signal about which assets they believe will have institutional-grade liquidity in the next cycle.

Solana is now the third blockchain — after Bitcoin and Ethereum — to enter the institutional ETF pipeline. For retail investors wondering which L1s have staying power, the institutional money is starting to place its bets.

What This Week Actually Means

The crypto market didn't have a single narrative this week. It had two, running in opposite directions:

The Closing Door: Privacy coins face coordinated regulatory pressure. InfoFi protocols lost their platform access. Interest-bearing stablecoins are now explicitly in TradFi's crosshairs.

The Opening Door: Canton Network processes $300 billion daily for the world's largest banks. Morgan Stanley filed for a Solana ETF. DTCC is tokenizing treasuries. Interactive Brokers will offer Ripple and PayPal stablecoins starting January 22nd.

The assets moving through the closing door share one characteristic: they compete directly with regulated financial services without regulatory approval.

The assets moving through the opening door share a different characteristic: they make regulated financial services more efficient, with full regulatory compliance.

This isn't about crypto becoming "boring" or "captured." It's about the market finally pricing in which use cases regulators will tolerate and which they won't.

The Bottom Line

If you're building, investing in, or using cryptocurrency, this week drew clear lines:

Regulatory green light: Tokenized treasuries, compliant stablecoins, SEC-registered ETFs, institutional settlement infrastructure, robot/machine payment rails.

Regulatory red light: Complete transaction anonymity, interest-bearing stablecoins without banking licenses, any protocol dependent on social media API access.

The opportunity isn't gone. It's just moved.

Canton Network proves that blockchain infrastructure can handle institutional scale. Morgan Stanley's filing proves that Solana has crossed the institutional credibility threshold. The robot economy protocols prove that crypto still has genuine use cases that traditional finance can't address.

But the days of building protocols that directly compete with regulated banking — without becoming regulated themselves — are ending faster than most market participants realize.

The 18-hour regulatory response to Monero's all-time high was the clearest signal yet: regulators are paying attention, and they're moving fast.

This analysis is part of APAC FinStab+'s weekly regulatory intelligence coverage. For the full dashboard including cross-jurisdictional policy tracking, compliance risk assessments, and institutional flow monitoring, visit apacfinstab.com.

Subscribe to our weekly intelligence brief at blog.apacfinstab.com for early access to regulatory developments before they move markets.