When BlackRock Buys Into DeFi and Brazil Bans Synthetic Dollars: What the USD1, BUIDL, and ENA Stories Tell Us About the Real Crypto Power Shift

There's a moment in every industry's evolution when the people who built the old world stop watching from the sidelines and start laying bricks in the new one. This week, that moment arrived — not once, but three times — and the signals are so loud that ignoring them would be professionally irresponsible.

Let me explain.

The $4.7 Billion Bet That Lives on One Server

Here's a number that should make every treasury manager lose sleep: 87%.

That's the share of USD1's total supply — $4.7 billion out of $5.4 billion — sitting on a single exchange: Binance. No stablecoin in history has ever had this level of concentration at one venue. Not Tether. Not USDC. Not even the algorithmic coins that blew up in 2022.

To understand why this matters, forget crypto for a second. Imagine a bank that keeps 87% of all its customer deposits in one vault, in one building, in one city. Now imagine that vault's security depends not on locks and guards, but on a political handshake between two individuals — one running the world's largest crypto exchange, the other running the United States.

That's USD1 in February 2026.

This isn't a stablecoin in any traditional sense. It's a bilateral political-financial arrangement wearing the costume of a dollar-pegged token. The moment the Binance-CZ-Trump alignment experiences friction — regulatory, personal, or strategic — there's no distributed liquidity buffer to catch the fall. Depegging wouldn't take days. It would take hours.

The compliance implication is immediate: if your treasury, your exchange, or your protocol has any USD1 exposure, you're not taking stablecoin risk. You're taking single-counterparty political risk at a scale no institution should be comfortable with.

Brazil Just Drew a Line That Will Reshape Global Stablecoin Regulation

While most crypto observers were focused on American politics this week, Brazil quietly did something no other major jurisdiction has done: it formally distinguished between backed stablecoins and synthetic stablecoins at the regulatory level, and it banned the latter.

The immediate casualty? ENA's USDe, a $12 billion synthetic dollar that maintains its peg not through fiat reserves in a bank, but through delta-neutral derivative positions. In traditional finance terms, it's like a money market fund that holds no cash — just perfectly hedged bets that the dollar stays the dollar.

The distinction Brazil has drawn is deceptively simple but profoundly consequential: How you maintain your peg matters as much as whether you maintain it.

This isn't an academic debate. It's the beginning of a global regulatory template. Hong Kong opens its stablecoin licensing window in March. Singapore has been tightening its framework all year. Japan revised its stablecoin act in 2025. Every one of these jurisdictions is now watching what Brazil did and asking: should we draw the same line?

If you're building on, integrating with, or holding any synthetic stablecoin — USDe, algorithmic models, or derivative-backed instruments — your regulatory risk profile changed this week. Not because of a price crash. Because of a classification.

BlackRock Didn't Just "Enter DeFi." It Bought the Furniture.

The single most significant event in crypto this week wasn't a coin launch, a hack, or a regulation. It was a purchase order.

BlackRock — the company managing $11.5 trillion in assets, more than the GDP of every country except the US and China — deployed its tokenized treasury fund BUIDL directly onto Uniswap, a decentralized exchange that anyone with an internet connection can use. Then it did something even more telling: it bought UNI tokens directly. Not through a fund. Not through a proxy. BlackRock acquired governance tokens of a DeFi protocol.

A whale wallet that had been dormant for four years moved 4.39 million UNI tokens right before the announcement. UNI spiked 14% in hours.

Let's be very clear about what this means. The largest asset manager on Earth just told the market: public decentralized exchange infrastructure is compliant enough for us to deploy institutional capital on. Every compliance department at every bank, every fund, every family office that was waiting for "institutional validation" of DeFi just got their answer.

But BlackRock isn't alone. This week also saw:

JPMorgan and Goldman Sachs's Canton Network processing tokenized assets through the same infrastructure that the Bank of England is now piloting for atomic settlement between tokenized assets and central bank money — using Chainlink's CCIP protocol.

Robinhood launched a chain testnet built on Arbitrum. Not integrating with crypto. Building its own blockchain. A brokerage with 23 million users decided that the future of finance requires its own settlement layer.

Ondo filed with the SEC for compliance while managing $2 billion in tokenized treasuries and 65% of all tokenized equity volume.

The pattern is unmistakable: traditional finance is not "adopting crypto." It's building parallel infrastructure on crypto rails. The institutions aren't buying tokens. They're buying the plumbing.

The Compliance Standard That No Regulator Wrote

Here's something that should worry regulators and excite builders in equal measure: Coinbase launched Agentic Wallet this week with a new standard called ERC-8021 — a framework for attributing financial transactions to AI agents.

There are now over 1.5 million autonomous AI agents deployed across blockchain networks. They trade. They lend. They move capital. And until this week, not a single jurisdiction on Earth had proposed a framework for identifying who they are or what they do.

Coinbase didn't wait. With 110 million users as its distribution channel, it embedded agent transaction attribution directly into its wallet infrastructure. The message to regulators: We've already built the compliance layer. Now it's your turn to make it official.

This is a pattern we've seen before in technology regulation. Industry standards become de facto regulation. Visa didn't wait for governments to define electronic payment security — it built PCI-DSS and told everyone to comply. Coinbase is making the same play for autonomous AI finance.

The window between "industry standard" and "regulatory mandate" is where fortunes and compliance strategies are made. We're in that window now.

The USDT Signal Nobody's Talking About

Buried in this week's stablecoin data: Tether burned $3.5 billion in USDT supply. That's not a rounding error. That's a contraction signal.

Meanwhile, Circle minted $4.5 billion in USDC on Solana in just seven days. The Ethereum-to-Solana USDC ratio compressed from 30x to 23.7x — meaning Solana is absorbing institutional stablecoin demand faster than any other chain.

These two data points together tell a structural story: stablecoin market share is being redistributed in real time. USDT is contracting. USDC is expanding, specifically on Solana. The chain that critics dismissed as "retail playground" is becoming the institutional stablecoin settlement layer — while Ethereum saw net stablecoin outflows.

For compliance teams, the operational question has shifted from "which stablecoin?" to "which stablecoin on which chain in which jurisdiction?"

What This All Means: The Three-Layer Regulatory World Is Here

Pull back far enough and this week's events reveal the architecture of what we've been calling the "three-layer regulatory world":

Layer 1: Fully Regulated Assets. BlackRock's BUIDL on Uniswap. Canton Network with Bank of England settlement. ONDO's SEC filing. CRO and AAVE ETFs. These assets and protocols have crossed the compliance threshold. They are, for all practical purposes, regulated financial infrastructure.

Layer 2: Jurisdictionally Fragmented Assets. USD1 with its Binance concentration risk. USDe facing Brazil's synthetic ban but operating freely elsewhere. CRO getting ETF approval while simultaneously reminting 70 billion tokens. The same asset can be compliant in one jurisdiction and banned in another. Compliance is no longer binary — it's geographic.

Layer 3: The Unregulated Frontier. 1.5 million AI agents operating with no identity framework. Agent launchpads generating millions in fees with no licensing. Autonomous financial operations that no jurisdiction has even attempted to classify. Coinbase's ERC-8021 is the first bridge between this layer and Layer 1 — but it's a private bridge, not a public one.

The actionable insight: your regulatory strategy now needs to operate across all three layers simultaneously. An asset that's compliant in Layer 1 jurisdictions may face restrictions in Layer 2 markets and interact with unregulated Layer 3 infrastructure. The entities that thrive in 2026 will be those that can navigate this complexity — not those that pretend it doesn't exist.

Key Dates to Watch

- Feb 17: Figure blockchain stock pricing — first regulated blockchain equity market signal

- Feb 20: XRP permissioned DEX launch — regulated exchange infrastructure milestone

- March (Early): Hong Kong stablecoin license window opens — critical for synthetic vs backed classification

- March 26: Aster mainnet launch — tests whether product execution can overcome token trust crisis

- Ongoing: MegaETH TGE milestone tracking — first conditional token launch tied to ecosystem metrics

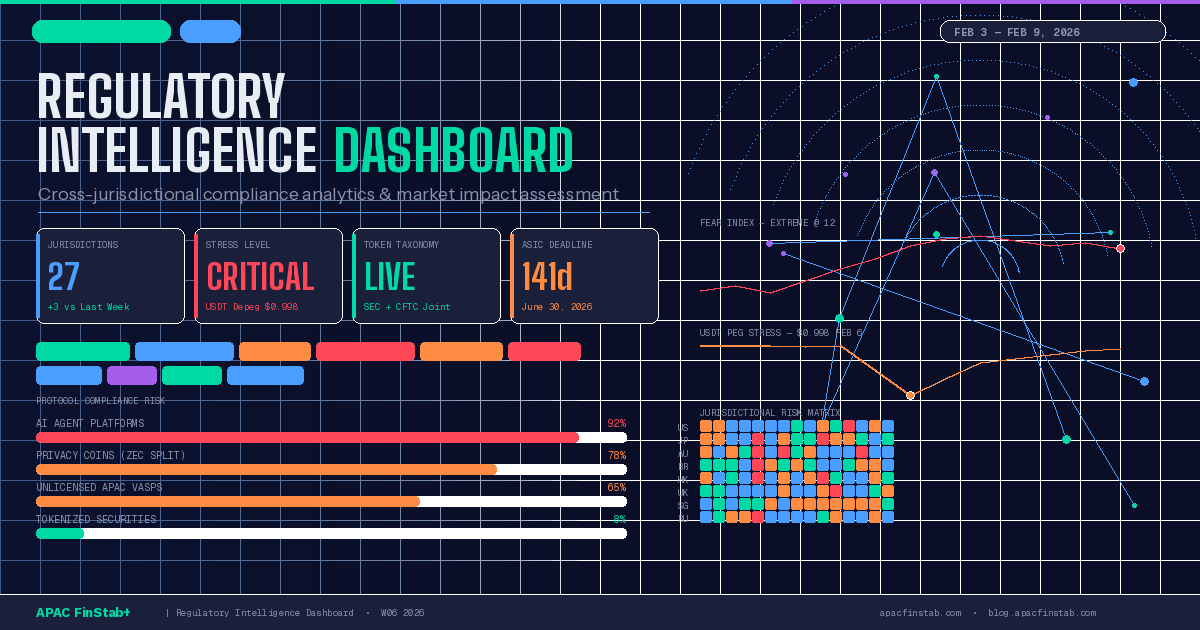

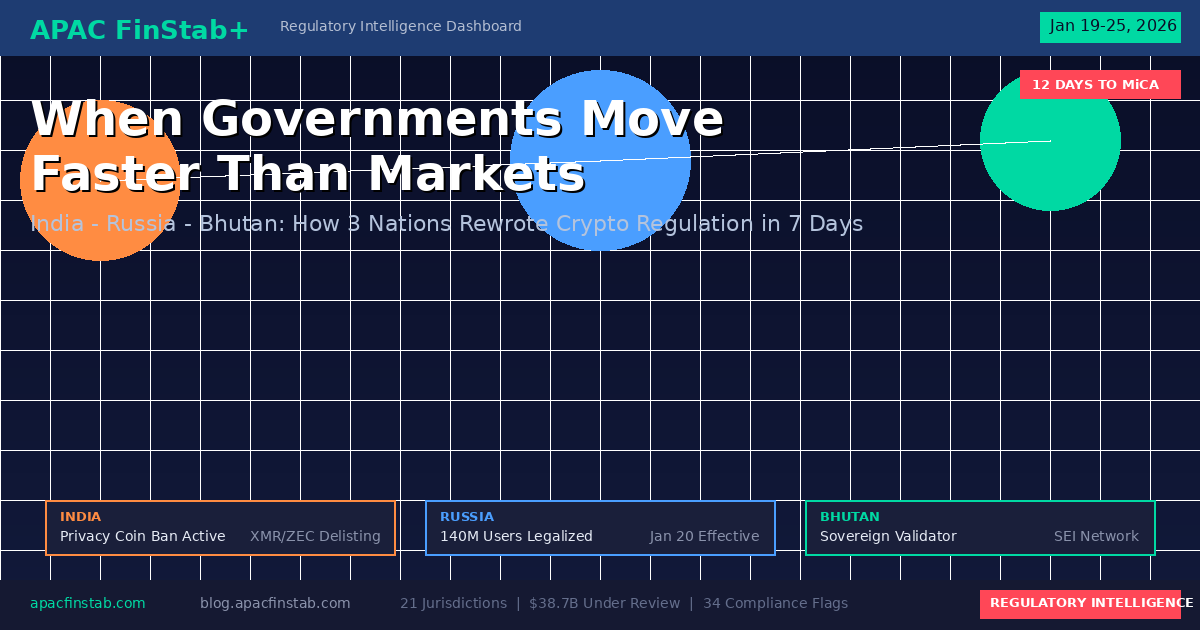

This analysis is part of the APAC FinStab+ Regulatory Intelligence Dashboard, published weekly at blog.apacfinstab.com. For the full interactive dashboard with cross-jurisdictional policy matrices, compliance risk assessments, and institutional rail tracking, visit apacfinstab.com.

Disclaimer: This report is for informational and research purposes only. It does not constitute legal advice, compliance recommendations, or investment guidance. Consult qualified legal counsel before making operational decisions.