Three 48-Hour Windows That Will Define Crypto's Next Phase: Zcash, Ethereum, and the x402 Payment Revolution

A deep dive into the institutional signals, regulatory arbitrage windows, and validation tests happening right now—and what they mean for the next 6 months of digital assets.

Why the week of November 17-22, 2025 matters more than any government policy announcement

The Paradox No One Is Talking About

On November 14th, 2025, the United States government officially ended a 43-day shutdown—one of the longest in modern history. Markets should have celebrated. Crypto investors should have cheered the return of "normalcy."

Instead, something strange happened.

Bitcoin ETFs saw $866 million flow out in a single week. BlackRock alone recorded a $473 million single-day outflow—the largest since the ETF's launch. The Fear & Greed Index, a sentiment tracker for crypto markets, dropped to 20—the lowest reading in seven months.

This wasn't supposed to happen. Political gridlock ending should mean money returns. But it didn't.

Welcome to what institutional investors are quietly calling "The Liquidity Trap"—and it's just one of three critical 48-hour windows happening right now that will determine whether crypto enters a new institutional era or faces another prolonged winter.

Window #1: The Privacy Coin That Went From $26M to $10B (And Why It's a Bubble)

Let's rewind to February 2025. Zcash (ZEC), a privacy-focused cryptocurrency, was worth roughly $26 million in total market capitalization. It was delisted from exchanges, ignored by institutions, and generally considered "dead money" by most traders.

By November 16th, 2025—just nine months later—Zcash hit a $10 billion market cap. That's a 38,361% increase. It became the #1 most-searched cryptocurrency on CoinGecko, surpassing Bitcoin and Ethereum. Its perpetual futures contracts reached $1.03 billion in open interest, making it the 6th most-traded derivative globally.

What happened?

The 73 Delistings That Changed Everything

In 2024, 73 major exchanges delisted Monero (XMR)—the leading privacy coin—due to regulatory pressure. Monero's absolute privacy features made it incompatible with the new global Anti-Money Laundering (AML) frameworks that were being enforced across jurisdictions.

But here's where it gets interesting: Zcash has "optional privacy."

Unlike Monero, where every transaction is private by default, Zcash allows users to choose between transparent (public) and shielded (private) transactions. This single feature made it the only privacy coin that institutions could legally hold without violating compliance rules.

When Winklevoss Capital (the firm behind Gemini exchange) announced an "all-in allocation" to privacy coins in mid-November, and when MetaMask (with 100 million users) integrated Ethereum's Kohaku SDK to offer default privacy features, it became clear: privacy wasn't dead—it was just getting rebranded as "institutional-grade selective confidentiality."

But Here's the Problem: The 181% APR Warning Signal

As I write this, Zcash's funding rate—the cost to hold leveraged positions—is sitting at 181% annualized.

To put that in perspective: if you're holding a leveraged long position on Zcash, you're paying 0.17% every 8 hours just to keep the position open. That's unsustainable. Historically, whenever a crypto asset's funding rate exceeds 100% APR, it corrects by 30% or more within 7-14 days.

This isn't a prediction model. It's a pattern that's held true for Bitcoin in 2021, Solana in 2023, and meme coins throughout 2024.

The window is closing. Zcash's "regulatory arbitrage opportunity"—the 2-4 week period where it's the only compliant privacy option before regulators catch up or competitors emerge—is already halfway through. The smart money that got in at $300-400 is starting to exit. Retail is still buying at $500+.

Window #2: The $582 Million Whale vs. The Daily 45,000 ETH Sellers

While everyone was watching Bitcoin, something fascinating was happening with Ethereum (ETH).

Between November 12-14th, multiple new wallet addresses accumulated 163,680 ETH—worth approximately $582 million—at an average price between $3,000 and $3,200. This wasn't a single whale. It was coordinated institutional buying across several entities, all entering at the same price range.

At the exact same time, long-term holders (wallets that had held ETH since 2021) were selling 45,000 ETH per day—the highest daily sell rate since February 2021.

Let me put those numbers in context:

- New buyers: $582 million per week

- Old sellers: $153 million per day × 7 = $1.07 billion per week

The old holders are selling nearly twice as fast as new buyers are accumulating.

So why are institutions buying into a net-negative flow?

The $3,000 Line in the Sand

That price range—$3,000 to $3,200—isn't random. It represents:

- Institutional cost basis: Several large funds entered Ethereum positions in this range during 2024's accumulation phase

- Technical support: The 200-week moving average converges here

- Liquidation threshold: If ETH breaks below $3,000, it triggers approximately $2.3 billion in cascading liquidations across Aave and Compound—two of DeFi's largest lending protocols

The new buyers aren't betting on Ethereum's technology. They're betting on $3,000 being the floor—a self-fulfilling prophecy if enough capital believes it.

But there's a ticking clock: the old holders selling 45,000 ETH per day are wallets that bought ETH at under $1,000. They have enormous profit cushions. If they accelerate their selling—say, to 60,000 or 80,000 ETH per day—the new buyers' $582 million weekly inflow won't be enough to absorb it.

The 48-hour window: November 20th is the key date. Technical analysts are forecasting that if ETH holds above $3,000 through November 20th, and if the Fear Index rebounds from 20 to around 28±5, it confirms bottom formation. If not, we're heading for a second dip—potentially to $2,700-2,800.

Window #3: The x402 Payment Protocol—$34 Billion Valuation or Elaborate Scam?

This is the one that fascinates me most, because it's playing out in real-time as you read this.

Between November 17-22, 2025, somewhere between 3-5 new cryptocurrency projects will launch their tokens. All of them are part of something called "x402"—a payment protocol integrated into AI agents (autonomous software programs that can execute transactions).

Here's why it matters: JPMorgan analysts valued the x402 infrastructure at $34 billion. The current market cap of all x402-related tokens? $30 million.

That's a 1,133x valuation gap.

Either this is the opportunity of the decade, or it's the most overhyped narrative in crypto right now.

The PING Warning Sign

The first x402 token to launch was called PING. It went from $80 million market cap to $33 million in three weeks—a 59% collapse.

Why? Because PING had no actual product integration. It was purely a speculative token riding the x402 narrative wave.

Now, during November 17-22, we're about to see whether the legitimate infrastructure projects—the ones with real Coinbase integration, real transaction volume, real developer activity—can hold their valuations.

If 3 or more of these new tokens break below $50 million market cap within 48 hours of launching, it sends a clear signal: the market doesn't believe the $34 billion valuation thesis. It means x402 is vaporware—impressive technology with no business model.

But if they hold, or better yet, if one breakout token maintains $100M+ valuation with verifiable transaction data? That validates the infrastructure thesis and opens the door for a 6-month upward cycle.

The Coinbase Control Factor

Here's the wild card: Coinbase controls 88% of x402 transaction volume. They're the verification layer (through Chainlink), the settlement layer (through USDC), and the distribution layer (through their new "Agent SDK" developer kit).

If Coinbase decides to launch a competing payment protocol—essentially cutting out the x402 tokens entirely—this entire narrative collapses overnight. It would be like Google launching a competing product against a startup that relies on Google Cloud.

We'll know in 48 hours.

Why These Three Windows Are Connected

At first glance, these seem like unrelated events:

- A privacy coin bubble in Asia

- An Ethereum accumulation standoff in institutional circles

- A payment protocol validation test in the AI sector

But they're all symptoms of the same underlying shift: crypto is in the middle of a legitimacy test.

The Institutional Adoption Paradox

Institutions want in. We know this because:

- Grayscale increased ZEC holdings by 2,200%

- New wallets deployed $582 million into ETH

- Monetalis (an institutional OTC desk) bought $14.3 million of Uniswap tokens ahead of a governance vote

But they're not flooding in. They're waiting for regulatory clarity and narrative validation.

The U.S. government shutdown ending didn't bring clarity—it just ended a distraction. The real clarity comes from:

- The December FOMC meeting, where the Federal Reserve will signal interest rate policy for 2026

- The December 2nd Uniswap governance vote, which will test whether DeFi protocols can turn on fee generation without getting classified as securities

- The Q1 2026 stablecoin framework that Canada is rushing to implement

Until then, we're in what traders call "the policy vacuum"—a period where past uncertainty has lifted, but future direction isn't clear yet.

And in that vacuum, these 48-hour windows become proxy battles for larger narratives:

- Zcash's fate tests whether "regulated privacy" is viable or just a temporary arbitrage

- Ethereum's $3,000 line tests whether institutional capital can overpower legacy holder distribution

- x402 token launches test whether AI-payment integration is real infrastructure or venture capital hype

What This Means for the Next 6 Months

I'm going to be direct about what I see coming:

If the 48-Hour Windows Break Bullish:

- Zcash corrects 30-40%, then second-tier privacy coins (DASH, FIRO, ZEN) rally 50-79% on exchange re-listings

- Ethereum holds $3,000, confirms bottom, rallies to $3,500-3,800 into the December Pectra upgrade

- x402 tokens validate with $100M+ sustained market caps, opening 6-month adoption window

Portfolio implications: 50% main assets (BTC/ETH/SOL), 30% DeFi infrastructure (Hyperliquid, NEAR, Pendle), 15% emerging narratives (privacy tech, AI payments, protocol fee switches), 5% cash for tactical entries.

If the 48-Hour Windows Break Bearish:

- Zcash crashes 50%+, takes down privacy sector, "regulated privacy" thesis dies for 2-3 years

- Ethereum breaks $3,000, triggers $2.3B liquidations, tests $2,700-2,800 before finding support

- x402 tokens all break $50M, narrative collapses, "AI payments" becomes a 2026-2027 theme (too early)

Portfolio implications: 40% main assets, 20% DeFi defensives (Morpho, Ondo, OUSG), 40% stablecoins/cash waiting for Dec FOMC clarity.

The Base Case (Most Likely):

Markets muddle through. Zcash corrects but doesn't crash. Ethereum chops between $3,000-3,400. x402 tokens split—infrastructure survives, MEME layer dies.

This is the "consolidation phase" scenario, where nothing decisively breaks bullish or bearish until the December FOMC meeting provides actual policy direction.

The Bigger Picture: Why Liquidity Traps Matter More Than Narratives

Let me share something that institutional desks are saying behind closed doors:

"Narratives don't matter when there's no liquidity to express them."

The U.S. government shutdown ending should have been bullish. But the $866 million ETF outflow tells us that capital isn't returning to risk assets yet—it's going into money markets, short-term Treasuries, and gold.

Why? Because the shutdown ending doesn't resolve the underlying issue: interest rates are still high, and the Fed hasn't pivoted.

Every dollar that institutions could deploy into crypto is currently earning 5%+ risk-free in money markets. Until the Fed signals rate cuts (expected in the December FOMC meeting), that opportunity cost remains.

This is what makes these 48-hour windows so critical: they're happening in a liquidity-constrained environment. The winners will be projects that can attract capital despite the high opportunity cost. The losers will be narratives that need broader risk-on sentiment to work.

Privacy coins, institutional ETH accumulation, and x402 infrastructure are all liquidity-efficient narratives:

- Privacy has regulatory arbitrage urgency (limited time window)

- ETH has institutional cost-basis defense (self-fulfilling floor)

- x402 has Coinbase distribution control (concentrated, not dispersed)

Contrast this with, say, "new layer-1 blockchains" or "metaverse tokens"—narratives that require broad retail speculation and low opportunity costs to work. Those are 2026 themes, not November 2025 themes.

What You Should Be Watching

I'm not going to tell you what to buy. But I'll tell you what signals matter:

By November 20th:

- Fear & Greed Index: Does it rebound from 20 to 28±5? (confirms sentiment turning)

- ETH price: Does it hold $3,000 or break decisively below? (determines liquidation risk)

- ETF flows: Does the $866M weekly outflow slow to <$200M? (capital return signal)

By November 22nd:

- x402 token launches: Do 3+ projects hold $50M+ market cap 48 hours post-launch?

- LINK-Swift integration: Does the launch happen smoothly with verifiable transaction data?

By December 2nd:

- Uniswap governance vote: Does the fee-switch proposal pass with >60% yes votes?

- ZEC funding rate: Has it dropped from 181% to <50% APR (bubble deflation)?

By Mid-December:

- FOMC meeting: Does the Fed signal 2026 rate cuts or remain hawkish?

These aren't predictions. They're verification points. Markets move faster than narratives—by the time everyone agrees on the story, the opportunity is gone.

The Uncomfortable Truth About Timing

Here's what institutional investors understand that retail often misses:

Being right about the narrative doesn't matter if you're wrong about the timing.

Zcash might be the future of institutional privacy. But if you bought at $550 when funding rates are 181%, you're going to lose money even if you're "right" long-term—because you'll get shaken out during the 30%+ correction.

Ethereum might bottom at $3,000. But if you didn't set a stop-loss at $2,950, and it cascades to $2,700, you just gave back months of gains.

x402 might be a legitimate $34 billion infrastructure opportunity. But if you bought PING at $80M instead of waiting for the legitimate projects, you're down 59%.

This is why 48-hour windows matter. They're narrative validation moments. They tell you whether the story you believe has enough capital supporting it to become reality in the near term—not in some theoretical future.

One Final Thought: The Regulatory Arbitrage That Everyone's Missing

While everyone's focused on U.S. regulation, something quiet is happening in Brazil.

On November 13th, Brazil announced a new crypto licensing framework with a $700,000 threshold for exchange licenses. Compare that to the EU's MiCA framework, which requires $1.5 million, or U.S. regulations, which can run into the tens of millions.

This creates what institutional strategists call "geographic regulatory arbitrage":

- Lower compliance costs

- Faster license approval

- Access to Latin America's 650+ million population

- Integration with Brazil's PIX instant payment system (used by 70%+ of Brazilians)

If you're a crypto project that can't afford U.S. or EU compliance, but you need regulatory legitimacy to attract institutional capital, Brazil just became your home base.

We're already seeing the playbook:

- Incorporate in Brazil, get licensed ($700k)

- Launch compliant stablecoin with PIX integration

- Offer institutional custody (Citibank is launching in 2026)

- Attract Latin American family offices and corporations

This is the next 12-18 month opportunity for projects that execute it correctly. But like privacy coins, x402, and ETH accumulation, timing is everything—the advantage exists until Brazil's regulatory costs rise or other jurisdictions undercut them.

Conclusion: The Map Is Not the Territory

I've given you three 48-hour windows, six verification points, and multiple scenario paths. But here's the truth:

Markets don't move in straight lines, and narratives don't play out cleanly.

Zcash might correct 30%, then rally 200% when XMR integrates with Thorchain in Q1 2026.

Ethereum might break $3,000, cascade to $2,700, then rocket to $4,000 on the Pectra upgrade in December.

x402 might see half its tokens collapse while one breakout project captures the entire infrastructure narrative.

The point of analyzing these windows isn't to predict the future—it's to understand the present deeply enough to adapt quickly.

Because in crypto, being 10% right 3 days early is worth more than being 100% right 3 months late.

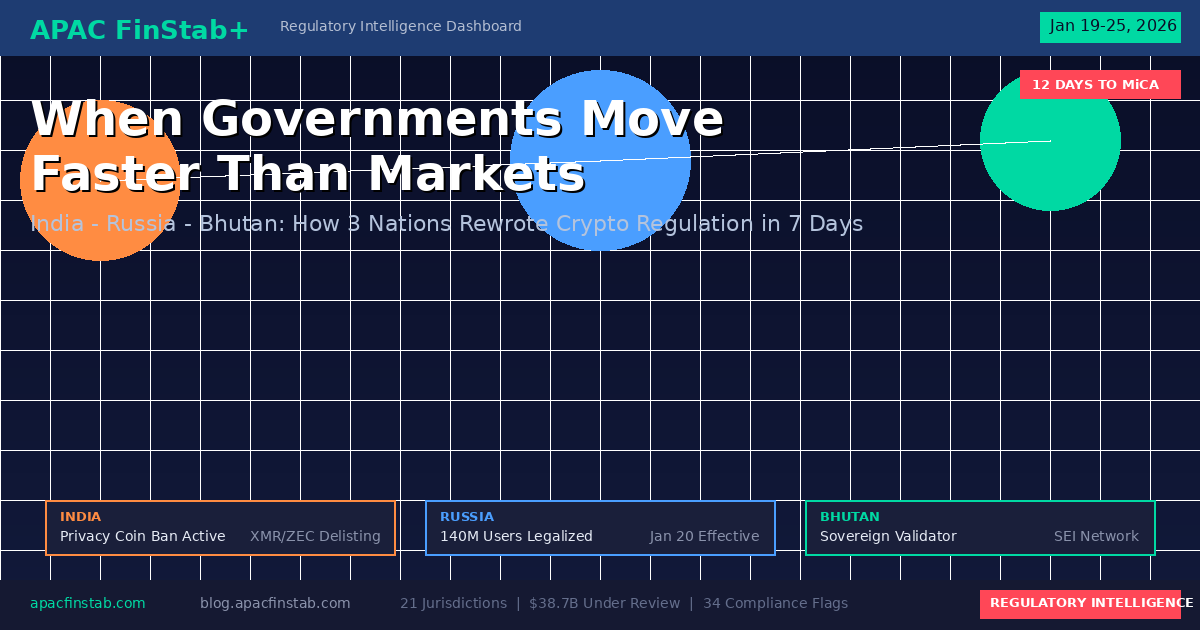

APAC FinStab+ tracks these regulatory, institutional, and market signals in real-time. This analysis is part of our weekly intelligence briefing for institutional investors and VIP traders across Asia-Pacific and beyond.

📊 Full dashboard with live data: apacfinstab.com

📝 Subscribe to weekly briefings: blog.apacfinstab.com

Next briefing covers: December FOMC implications, Monad post-launch analysis, and the Uniswap fee switch referendum results.

Disclaimer: This analysis consolidates publicly available data and regulatory intelligence for informational purposes only. Not financial advice. Markets can remain irrational longer than you can remain solvent. Do your own research, manage your risk, and never invest more than you can afford to lose. Historical patterns don't guarantee future outcomes.

About APAC FinStab+

We provide institutional-grade regulatory intelligence and market analysis for digital assets across Asia-Pacific. Our research combines on-chain data, institutional flow tracking, policy monitoring, and statistical anomaly detection to identify opportunities and risks before they become consensus.

Data sources: On-chain analytics (Etherscan, Dune), institutional filings (13F, 8-K), exchange data (Binance, Coinbase), regulatory announcements (SEC, MAS, SFC), DeFi protocols (Aave, Compound, Uniswap), sentiment tracking (Fear & Greed Index, CoinGecko Trends).