The Week Wall Street Stopped Laughing at Crypto: How JPMorgan, Swift, and the SEC Are Quietly Building the New Financial Rails

When the world's largest payment network validates blockchain settlement, and the SEC starts handing out permission slips, we're no longer talking about speculation. We're watching infrastructure get built.

The Quiet Revolution Happening in Plain Sight

Last week, while most financial headlines focused on interest rates and earnings reports, something far more significant happened in the plumbing of global finance.

Swift—the messaging network that moves $150 trillion annually between banks—validated USDC as a settlement layer.

Read that again.

The same network that processes nearly every international wire transfer you've ever sent is now testing cryptocurrency for settlement. Not in a sandbox. Not in a pilot program buried in a press release. In production.

If even 1% of Swift's correspondent banking volume migrates to blockchain rails, USDC's circulation jumps from $74 billion to $240 billion. Circle's annual revenue hits $24 billion. And the "crypto is just speculation" narrative dies a quiet death in the back offices of every major bank.

But Swift wasn't alone. This was the week the dam broke.

The Permission Slip Nobody Saw Coming

On November 25th, the SEC did something it almost never does: it told two cryptocurrency projects they could operate without fear of enforcement.

Jito and FUSE received "No-Action Letters"—making them only the second and third tokens in history to receive explicit SEC clearance.

For the uninitiated, a No-Action Letter is essentially the SEC saying: "We've looked at what you're doing, and we're not going to sue you." In an industry where regulation-by-enforcement has been the norm, this is extraordinary.

The template that emerged is instructive:

- Utility-based: The token does something functional, not just speculative

- No profit expectation: Holders aren't promised returns

- Distributed governance: No single entity controls the network

Jito now carries 40% of Solana's mainnet stake. That's not a meme coin. That's infrastructure with regulatory blessing.

For institutions that have been sitting on the sidelines waiting for "regulatory clarity," the clarity just arrived. The question now is whether they'll recognize it.

When Goldman Sachs' Competitor Shows Up On-Chain

The same week the SEC handed out permission slips, one of the world's largest market makers made a different kind of statement.

Flow Traders—a global top-three market making firm—became the first traditional market maker to provide liquidity on a decentralized exchange.

This isn't a crypto-native firm playing in DeFi. This is a firm that trades $10+ billion daily on traditional exchanges, that makes markets in everything from Dutch government bonds to ETFs, showing up on-chain.

Their venue of choice? CAP—a perpetual futures platform doing $62 billion in weekly volume.

The implications are profound:

Traditional market makers have historically been the moat around centralized exchanges. They provide the liquidity that makes trading possible. They're why you can buy Apple stock at 9:31 AM and sell it at 3:59 PM without worrying about finding a counterparty.

When those same market makers start providing liquidity on-chain, the competitive advantage of centralized venues erodes. The "institutions will never use DeFi" argument dies the moment institutional market makers show up.

Coinbase noticed. They listed CAP futures within days.

The $150 Trillion Validation

If Flow Traders showing up on-chain was a signal, Swift's move was a foghorn.

Swift validating USDC for settlement isn't an experiment. It's an acknowledgment that blockchain rails are ready for institutional volume.

The math is simple but staggering:

- Swift processes ~$150 trillion annually

- Current USDC circulation: $74 billion

- 1% migration = $1.5 trillion annual volume on USDC rails

- Required circulation to support that volume: ~$240 billion

Circle has been printing money—literally. Since October 11th, they've minted $12.25 billion in USDC. Another $1 billion in the last 24 hours of November alone.

This isn't retail speculation driving stablecoin demand. This is infrastructure preparation.

The Warning Shot Nobody Wanted to Hear

Not everything this week was bullish.

S&P rated Tether's reserves 5 out of 10—"weak"—citing that their 5.6% Bitcoin allocation exceeds the 4% safety buffer.

The rating agency's math is uncomfortable: if Bitcoin drops 30%, Tether can't pay everyone back. The peg breaks mathematically.

The market is already voting. While Tether's reserves raise eyebrows, Circle has printed $12.25 billion in USDC since October. The stablecoin shift isn't coming—it's happening.

For institutions holding USDT exposure, the S&P warning is a compliance red flag they can't ignore. Risk committees don't care about crypto ideology. They care about ratings and reserves.

The AI Payment System Operating Without a License

Perhaps the most consequential development this week happened in a protocol most people have never heard of.

x402—an AI agent payment protocol—processed over $250 million in transactions this week. It has no KYC layer. 95% of volume settles on a single blockchain. And regulators haven't figured out it exists yet.

This is the compliance time bomb ticking in plain sight.

The numbers are staggering: 40 million transactions, 90% from AI agents paying for services, 1 million+ registered agents. This isn't a testnet. This is a production system facilitating a quarter-billion dollars in payments without identity verification.

When (not if) regulators notice, the 95% Base chain concentration means a single enforcement action could crater the entire ecosystem.

For institutions building in this space, the message is clear: implement identity verification before the SEC does it for you.

The Institutions Are Already Here

The narrative that "institutions are coming" to crypto has been repeated so often it became a joke. But this week's data suggests the joke is on the skeptics.

Securitize processed Apollo's $1.2 billion ACRED fund on-chain. Not a proof of concept. A billion-dollar fund from one of the world's largest alternative asset managers.

YLDS—a yield-bearing stablecoin—hit $780 million in TVL. It's SEC-registered as a debt security. Its underlying assets are identical to BlackRock and Fidelity holdings. Ondo invested $25 million.

Real-world asset (RWA) holders hit an all-time high of 105,000 addresses holding $800 million.

This isn't speculation. These are tokenized treasury bills, money market funds, and private credit—the same boring-but-profitable assets that institutional allocators have owned for decades, now on blockchain rails.

The difference? 24/7 settlement, instant transferability, and yields that compound in real-time instead of monthly statements.

What Happens Next

The pieces are now in place:

- Regulatory clarity for utility tokens (SEC No-Action Letters)

- TradFi market makers providing on-chain liquidity (Flow Traders)

- Settlement infrastructure validated by the world's largest payment network (Swift + USDC)

- Institutional-grade products with real yields (YLDS, Securitize/Apollo)

- Principal-protected exposure for conservative allocators (JPMorgan structured products)

The next 90 days will determine whether these rails carry institutional volume or remain curiosities.

Key dates to watch:

- December 3: Fusaka upgrade (Face ID transaction signing)

- December 10: Umbra privacy mainnet (50+ SDK integrations)

- December 18: FOMC decision (liquidity inflection point)

- January 2026: MiCA full enforcement (EU compliance deadline)

The infrastructure is built. The permissions are granted. The market makers have arrived.

The only question left: who's paying attention?

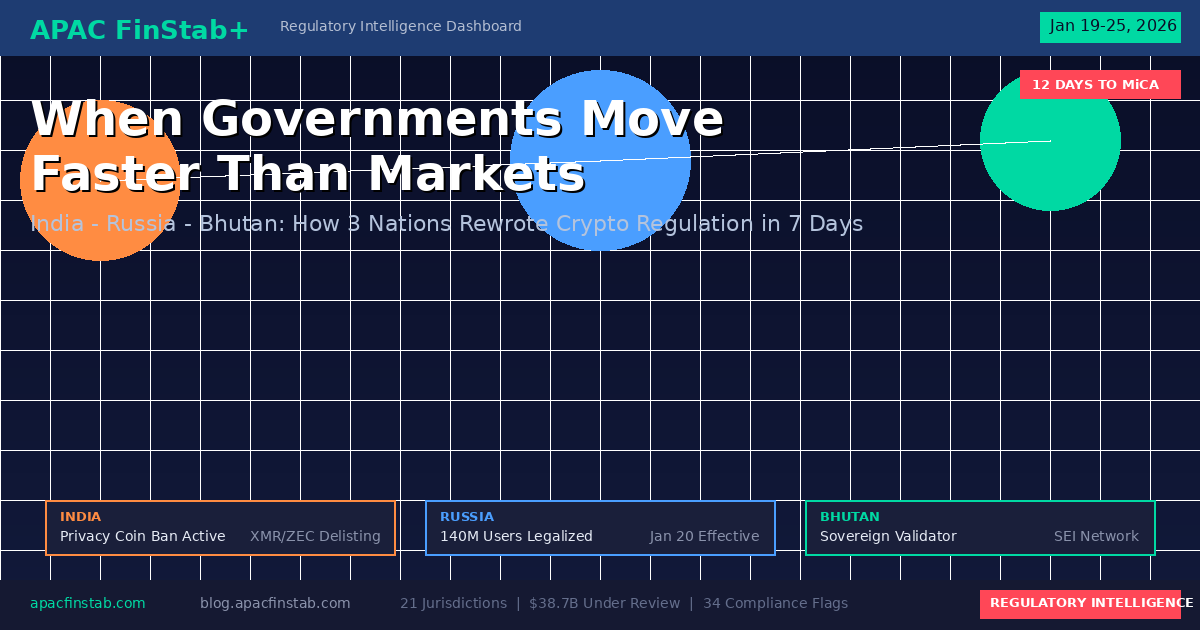

For the full regulatory intelligence dashboard with jurisdiction-by-jurisdiction analysis, capital flow tracking, and compliance action requirements, visit apacfinstab.com.

Subscribe to APAC FinStab+ for weekly intelligence reports delivered to your inbox: blog.apacfinstab.com