Do Kwon's Reckoning, Sony's Stablecoin, and the Week Wall Street Quietly Built Crypto Rails Without Asking Permission

The Courtroom That Could Change Everything

In four days, a courtroom in Podgorica, Montenegro will hand down a sentence that has nothing to do with the price of Bitcoin—and everything to do with the future of cryptocurrency.

Do Kwon, the architect of the $60 billion Terra/LUNA collapse that wiped out life savings across three continents, faces judgment on December 11th. But this isn't just about one man's fate. It's about whether the world's legal systems have finally figured out how to hold crypto founders accountable.

Think of it as crypto's Enron moment.

When Jeffrey Skilling and Kenneth Lay faced prosecution, it wasn't just about Enron. It established that corporate executives couldn't hide behind complexity. The legal playbook written in those Houston courtrooms became the template for white-collar prosecution for decades.

Montenegro's ruling will do the same for crypto. Every algorithmic stablecoin founder, every DeFi protocol developer, every token issuer watching will learn exactly where the new lines are drawn.

The smart money isn't waiting for the verdict. It's already repositioning.

The Week America's Regulators Stopped Fighting Each Other

Something remarkable happened this week that barely made headlines: the CFTC and SEC issued major crypto approvals within 48 hours of each other.

On December 2nd, the CFTC greenlit Kalshi to offer spot Bitcoin prediction markets. Within days, $13 billion in volume flooded through the newly-legal gates.

On December 3rd, the SEC approved staking for Ethereum ETFs. First-day inflows hit $140.2 million.

If you've followed the turf war between these agencies—Gary Gensler's SEC claiming everything is a security, the CFTC insisting it's a commodity—this coordinated approval is unprecedented. It suggests something the crypto industry has been begging for since 2017: regulatory clarity through cooperation rather than contradiction.

For institutional investors who've been waiting on the sidelines, the message is clear: the adults have figured out how to share the sandbox.

The Rails Being Built While You Weren't Looking

Here's what nobody's talking about: Wall Street is building crypto payment infrastructure that completely bypasses cryptocurrency exchanges.

This week alone:

BlackRock deployed $500 million through its BUIDL fund onto BNB Chain—in two weeks. Not through Coinbase. Not through Binance. Direct.

Canton Network—backed by BNY Mellon, NASDAQ, and S&P Global—quietly advanced its settlement infrastructure. These aren't crypto companies. These are the institutions that clear trillions in traditional securities.

150 Latin American banks connected through Rayls, which just launched with Brazil's central bank participating in pilots.

Western Union expanded USDPT, its Solana-based stablecoin, across 600,000 locations globally—capturing an $80 billion annual remittance flow.

The pattern is unmistakable: traditional finance isn't "getting into crypto." It's building parallel infrastructure that makes centralized exchanges increasingly irrelevant for institutional settlement.

If you run a crypto exchange, this should keep you up at night. The rails are being built. You're not on the construction crew.

Sony's Quiet Bombshell

Lost in the noise of price charts and token launches: Sony Bank confirmed it will launch a stablecoin in fiscal 2026.

Read that again. Sony Bank. A subsidiary of the company that brought you the Walkman, PlayStation, and Spider-Man movies is entering the stablecoin market.

This matters because Sony Bank isn't a crypto company trying to look legitimate. It's a legitimate Japanese financial institution choosing to adopt crypto infrastructure. The regulatory pathway required for a major Japanese bank to make this announcement took years of quiet groundwork.

Combined with Ripple's RLUSD receiving approval for Japan in Q1 2026, a pattern emerges: Japan isn't just tolerating crypto anymore. It's actively integrating it into mainstream banking.

The Latin American Banking Revolution Nobody Predicted

While American and European regulators debate frameworks, Brazil built one.

Rayls launched this week with integration into 150+ Latin American banks through Nuclea, Brazil's central payments infrastructure. The Brazil central bank isn't just observing—it's running pilots.

Mastercard is partnered. Tether is partnered. The Inter-American Development Bank is watching closely.

What makes this significant isn't the technology. It's the approach. Rather than fighting regulators or seeking regulatory arbitrage, Rayls built with regulators from day one. The result: institutional adoption at a pace that makes U.S. crypto companies look like they're moving in slow motion.

This is what happens when builders treat compliance as a feature rather than an obstacle.

The Unlock Avalanche Coming This Month

For those focused on shorter-term positioning, a wall of token unlocks is approaching:

- December 12: SUI ($150M) and ENA ($54M) unlock simultaneously

- December 13: TAO halving cuts emissions in half overnight

- December 17: PENGU unlocks 41% of total supply ($288M)

Combined, that's nearly half a billion dollars in new liquid supply hitting markets in a 5-day window.

The PENGU situation is particularly notable: team wallets have been moving $3 million to exchanges every few days. When insiders are pre-positioning for an unlock, retail should pay attention.

What This Means for You

If you're new to this space, here's the summary:

The legal infrastructure is being built. Do Kwon's sentencing will establish prosecution templates. CFTC and SEC coordination suggests regulatory frameworks are maturing.

The payment rails are being built. But not by crypto companies. Traditional finance is building its own infrastructure, and centralized exchanges may find themselves bypassed.

The geographic winners are emerging. Japan and Brazil are moving faster on institutional adoption than the U.S. or EU. Follow the banks, not the token launches.

The supply events matter. Half a billion in unlocks over five days creates opportunities—but only if you're positioned before, not after.

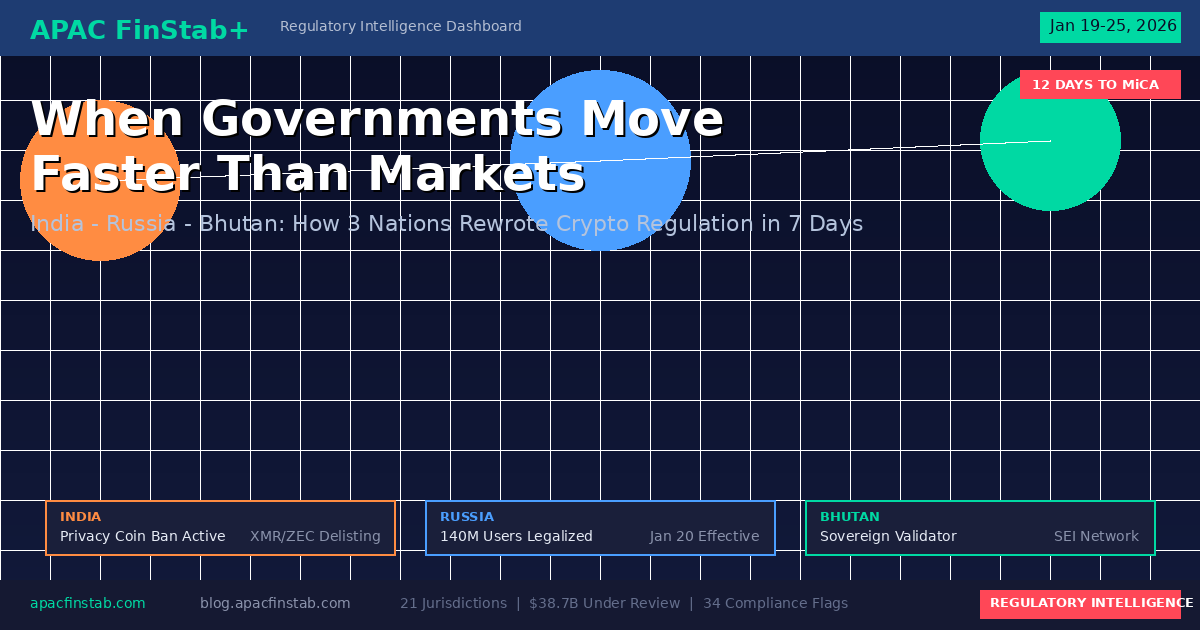

This analysis is from the APAC FinStab+ Weekly Intelligence Dashboard, tracking regulatory developments across 14 jurisdictions. For the full interactive dashboard with real-time updates, visit apacfinstab.com.

Subscribe to weekly intelligence briefings at blog.apacfinstab.com