Bhutan's Gold Token, JPMorgan's Solana Bond, and Kalshi's $11B Bet: The Week Crypto Went Mainstream

Three Stories That Changed Everything This Week

If you've been waiting for a sign that cryptocurrency is ready for serious money, this was the week.

Not because Bitcoin hit a new high. Not because some influencer made a prediction. But because three completely unrelated events happened within seven days—and together, they tell a story that Wall Street, regulators, and anyone with a retirement account should understand.

A Buddhist kingdom is backing crypto with gold bars. America's biggest bank just issued bonds on a blockchain built by a 30-year-old. And a startup that lets you bet on elections is now worth more than most regional banks.

Let's unpack what happened—and why it matters even if you've never owned a cryptocurrency in your life.

Story #1: The Kingdom That Put Gold on a Blockchain

Bhutan's TER Token Launches December 17th

Bhutan is a country of 780,000 people nestled between China and India. It's famous for measuring Gross National Happiness instead of GDP. It's not famous for financial innovation.

That's about to change.

On December 17th, Bhutan will launch TER—the world's first cryptocurrency token backed by a sovereign nation's gold reserves. Each token represents 0.1 grams of physical gold. If you accumulate 10,000 tokens, you can fly to Bhutan and walk out with a kilogram of actual, physical gold.

This isn't a startup's promise. This isn't a whitepaper dream. This is a government putting its national reserves on a blockchain and saying: "Here's the gold. Here's the token. Trade it, hold it, redeem it. It's real."

Why should you care?

Because the biggest obstacle to cryptocurrency adoption has never been technology. It's been trust.

When your financial advisor says "crypto is too risky," they're not talking about price volatility. They're talking about the fact that most crypto projects are backed by... nothing. Promises. Code. The hope that someone else will pay more later.

Bhutan just solved that problem.

"It's backed by a nation's gold reserves" is something pension funds understand. It's something compliance departments can approve. It's something regulators already know how to evaluate.

The launch includes a 15% discount for early buyers, which locks in roughly 14% profit before trading even begins. But that's not the important part.

The important part is what happens in the next 18 months. Because when one country creates a template, other countries copy it.

El Salvador has Bitcoin. The UAE has been building crypto infrastructure for years. Singapore's regulatory framework is the gold standard (pun intended).

Now Bhutan has sovereign gold tokens.

Which country announces next? My guess: somewhere in the Gulf, or a smaller Asian economy looking to attract international capital. The sovereign crypto race has officially begun.

Story #2: JPMorgan Put $50 Million on Solana

Yes, That JPMorgan. Yes, That Solana.

Let's talk about cognitive dissonance.

In 2017, JPMorgan's CEO Jamie Dimon called Bitcoin "a fraud" and said he'd fire any employee who traded it. In 2025, his bank just issued $50 million in commercial paper on Solana—a blockchain created by a developer who was 25 years old when Dimon made that statement.

The instrument is called USCP (US Commercial Paper). It settles on Solana. It's denominated in dollars. And it represents something that would have been unthinkable five years ago: a too-big-to-fail bank using public blockchain infrastructure for real financial products.

What changed?

Three things.

First, the technology matured. Solana can now process transactions in under a second for fractions of a penny. That's faster and cheaper than JPMorgan's internal systems.

Second, the regulatory environment clarified. The SEC isn't happy about everything in crypto, but they've stopped pretending blockchain doesn't exist. This week, they closed an investigation into Ondo Finance—a company that tokenizes treasury bills—with no charges. That's not approval, but it's not opposition either.

Third, the competition forced it. JPMorgan isn't doing this because they love crypto. They're doing it because their clients are asking for it, and if JPMorgan doesn't offer it, Goldman will.

What does this mean for you?

If you have money in a JPMorgan account—checking, savings, investment, whatever—your bank is now a blockchain company. They may not advertise it. They may not explain it. But the rails your money moves on are changing.

The same week JPMorgan made this move, State Street moved $200 million to Solana through Ondo. Apollo's $1.2 billion ACRED fund is settling on-chain. These aren't experiments anymore. They're operations.

Story #3: Kalshi Is Now Worth More Than Most Banks

A Prediction Market Startup Just Raised $1 Billion at an $11 Billion Valuation

Here's a company you've probably never heard of that's now worth more than Synchrony Financial, Zions Bancorporation, or First Horizon.

Kalshi lets you bet on real-world events. Will inflation be above 3%? Will the Fed cut rates? Who wins the election?

Unlike sports betting or casino gambling, Kalshi's markets are designed to aggregate information. The theory goes: if you can bet real money on whether something will happen, the collective wisdom of all those bets produces better predictions than any individual expert.

This week, Kalshi announced a $1 billion funding round at an $11 billion valuation. But the bigger news came from Washington: Kalshi's CEO was appointed to the CFTC's innovation council.

The CFTC is the Commodity Futures Trading Commission—the agency that regulates derivatives, futures, and (increasingly) crypto. Having Kalshi's CEO advising them is like having Uber's CEO advise the taxi commission. It signals that prediction markets are moving from regulatory gray zone to legitimate financial products.

Why does this matter?

Because prediction markets might be the most honest financial instrument ever invented.

When you buy a stock, you're betting a company will do well. But the stock price reflects thousands of other factors—Fed policy, sector rotation, passive fund flows, short squeezes. The signal is noisy.

When you buy a Kalshi contract on "Fed cuts rates in January," you're betting on exactly one thing. The contract settles at $1 if it happens, $0 if it doesn't. No noise. Pure signal.

Polymarket—another prediction platform—processed $4.33 billion in trading volume last month, all settling on the Polygon blockchain. The combination of Kalshi's regulatory legitimacy and Polymarket's crypto-native infrastructure suggests that prediction markets are becoming a permanent feature of financial markets.

For individual investors, this matters because prediction market prices are information. Before you make any investment decision, checking what the prediction markets say about relevant events—elections, rate decisions, regulatory actions—gives you a view into what thousands of other people with money at stake believe will happen.

That's not investment advice. That's information advantage.

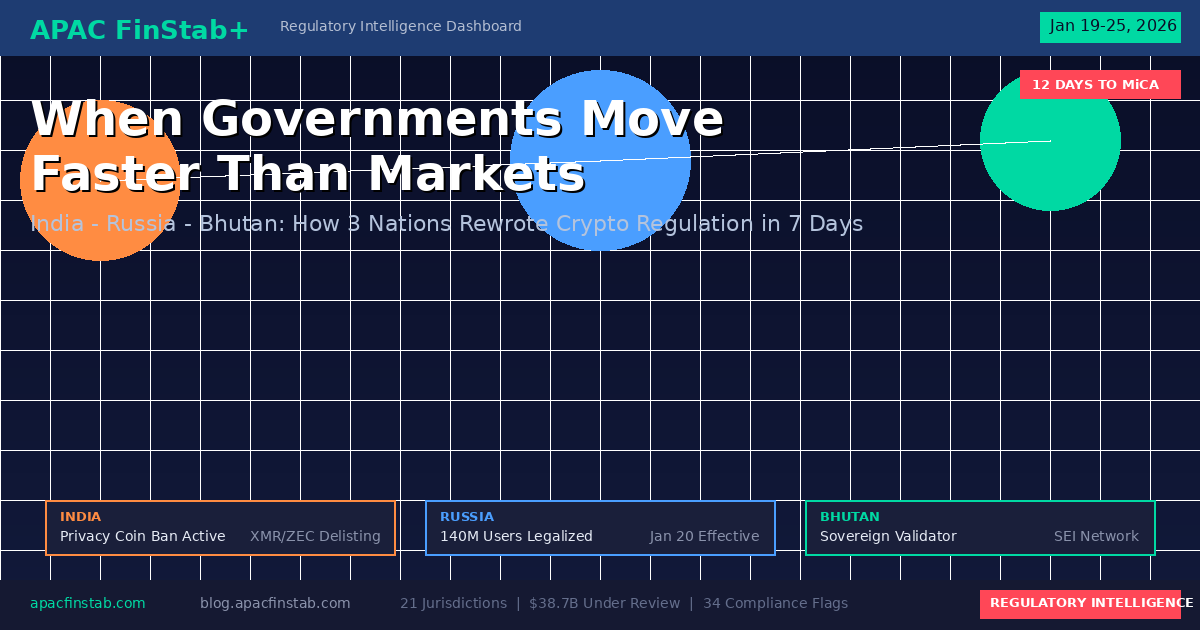

What's Happening in Asia (And Why Americans Should Care)

While these three stories dominated headlines, quieter shifts happened across Asia that will affect global markets for years.

Japan is upgrading crypto's legal status. The Financial Services Agency is moving crypto regulation from the "Payment Services Act" to the "Financial Instruments Act." In plain English: crypto is being reclassified from "payment tool" to "investment product"—the same category as stocks and bonds. This creates short-term compliance headaches for exchanges but long-term legitimacy for the entire industry. When Japan moves, Korea, Taiwan, and Hong Kong tend to follow.

South Korea is losing control. Korean crypto exchanges saw trading volume drop 8% this week as users migrated to decentralized platforms. The country's strict regulations, designed to protect investors, are instead pushing them to less regulated alternatives. This is the regulatory arbitrage problem that every jurisdiction faces: tighten too much, and activity moves somewhere else.

A $220 million hack tested DeFi's immune system. Cetus, a decentralized exchange, lost $220 million to an exploit. But here's what's interesting: validators froze $162 million of the stolen funds on-chain, and a community vote approved a recovery plan. The response mechanisms are maturing. Regulators noticed. Expect DeFi insurance mandates in Singapore and Hong Kong by late 2026.

The Stablecoin Problem Nobody's Talking About

If you hold any stablecoins—USDT, USDC, or others—this section is for you.

Stablecoins are supposed to be simple: tokens pegged to the dollar, useful for moving money around the crypto ecosystem without volatility. But regulatory fragmentation is turning them into a compliance nightmare.

This week, Tether's USDT received certification from Abu Dhabi's regulator (ADGM). Great news for USDT holders in the Middle East. But USDT's status in the United States remains unclear, and in the European Union, it doesn't meet MiCA requirements that take full effect in January.

Meanwhile, Circle's USDC is MiCA-compliant in Europe but faces questions about its reserves in other jurisdictions. PayPal's PYUSD is expanding but only useful within PayPal's ecosystem. Ripple's RLUSD is gaining traction but carries XRP's regulatory baggage.

The practical implication: your stablecoin strategy needs to match your geographic exposure.

| If you operate in... | Prioritize... |

|---|---|

| European Union | USDC, EURC |

| Middle East / Asia | USDT |

| United States | USDC |

| Multi-region | Diversified basket |

This isn't about which stablecoin is "best." It's about which ones your counterparties, banks, and regulators will accept where you do business.

Five Things to Watch Next Week

December 17: Bhutan TER gold token launch. Watch for pricing dynamics and institutional interest.

December 18: Theoriq mainnet. AI meets blockchain meets regulatory uncertainty.

December 19: Bitwise launches 10 crypto ETFs on NYSE Arca. The institutional product universe keeps expanding.

December 22: Solstice TGE. Another test case for compliant token launches.

January 2026: MiCA full enforcement. The deadline Europe's crypto industry has been ignoring.

The Bottom Line

This week wasn't about prices. It was about infrastructure.

A sovereign nation tokenized its gold reserves. America's largest bank issued bonds on a public blockchain. A prediction market startup joined the regulatory conversation.

These aren't speculative bets on future technology. They're operational deployments of current technology by institutions that can't afford to be wrong.

The question for everyone else—investors, businesses, regulators—is whether you're ready for what comes next.

The infrastructure is being built. The templates are being established. The window is opening.

What you do with that information is up to you.

This analysis is part of the APAC FinStab+ weekly intelligence series. For real-time regulatory tracking across 14 Asia-Pacific jurisdictions, visit apacfinstab.com. Subscribe to weekly briefings at blog.apacfinstab.com.