A Framework for Mapping RWA Products to Multi-Jurisdictional Compliance

The tokenization of real-world assets has reached an inflection point. Global RWA market cap (excluding stablecoins) surpassed $30 billion in Q3 2025, with private credit (~$17B) and U.S. Treasuries (~$7.3B) dominating the asset mix. Institutional players—BlackRock, Franklin Templeton, Goldman Sachs, BNY Mellon—are no longer experimenting; they are deploying. Yet beneath this momentum lies a fundamental engineering problem that most market participants underestimate: regulatory translation.

The same tokenized product—identical smart contract, identical underlying asset—can be classified as a "security" in the United States, a "virtual asset" in Hong Kong, an "electronic payment instrument" in Japan, and a "crypto-asset" under the EU's MiCA framework. Each classification triggers different disclosure requirements, custody rules, AML obligations, tax treatments, and distribution restrictions. For cross-border RWA issuers, this creates a combinatorial explosion of compliance permutations that cannot be navigated through manual legal analysis alone.

This report introduces the concept of a Regulatory Translation API—a systematic framework that transforms product-level inputs (product model, business model, token model, chain behavior) into jurisdiction-specific regulatory outputs (classification, risk mapping, compliance costs, gray zones, and trend forecasts). The framework is not a compliance shortcut; it is a structured methodology for making regulatory complexity tractable.

1. The Problem: Why RWA Compliance Is Computationally Hard

Traditional compliance frameworks were designed for a world where financial products had stable taxonomies. A bond was a bond. A share was a share. Regulatory classification was a one-time exercise, performed at issuance, reviewed periodically. Tokenized assets break this model in three ways.

1.1 Dynamic Classification: The Same Token Can Change Categories

Consider a tokenized money market fund share. At issuance, it may qualify as a "restricted security" under Regulation D, sold only to accredited investors through private placement. Six months later, the issuer enables secondary trading on a decentralized exchange. The token's chain behavior has changed—it is now tradable peer-to-peer, without intermediary oversight—but the underlying asset has not. Does this behavioral change trigger reclassification? In the United States, the answer depends on whether the trading activity constitutes a "public offering." Under Hong Kong's SFC framework, the answer depends on whether the trading platform is licensed. Under MiCA, the answer depends on whether the token meets the definition of an "e-money token" or an "asset-referenced token." Three jurisdictions, three different classification logics, all triggered by the same on-chain event.

1.2 Jurisdictional Arbitrage: Compliance Is Not Binary

The APAC region alone tracks 9+ distinct regulatory frameworks for digital assets. Singapore's MAS stablecoin regime applies to single-currency stablecoins pegged to SGD or G10 currencies. Hong Kong's VATP licensing regime governs platforms offering trading services to retail investors. Japan's FSA treats certain stablecoins as "electronic payment instruments" under the Payment Services Act, while others fall under the Financial Instruments and Exchange Act. South Korea's post-Terra/Luna framework introduces unique restrictions on algorithmic stablecoins. Each jurisdiction has different thresholds for retail vs. professional investor access, different AML/CFT requirements, and different tax treatments for token transfers.

For a cross-border RWA issuer, compliance is not a yes/no question. It is a multi-dimensional optimization problem: minimize compliance cost, maximize addressable market, maintain operational flexibility, and avoid regulatory gray zones that could trigger enforcement action in the future. Manual legal analysis cannot scale to this complexity.

1.3 Regulatory Velocity: The Rules Are Changing Faster Than Products

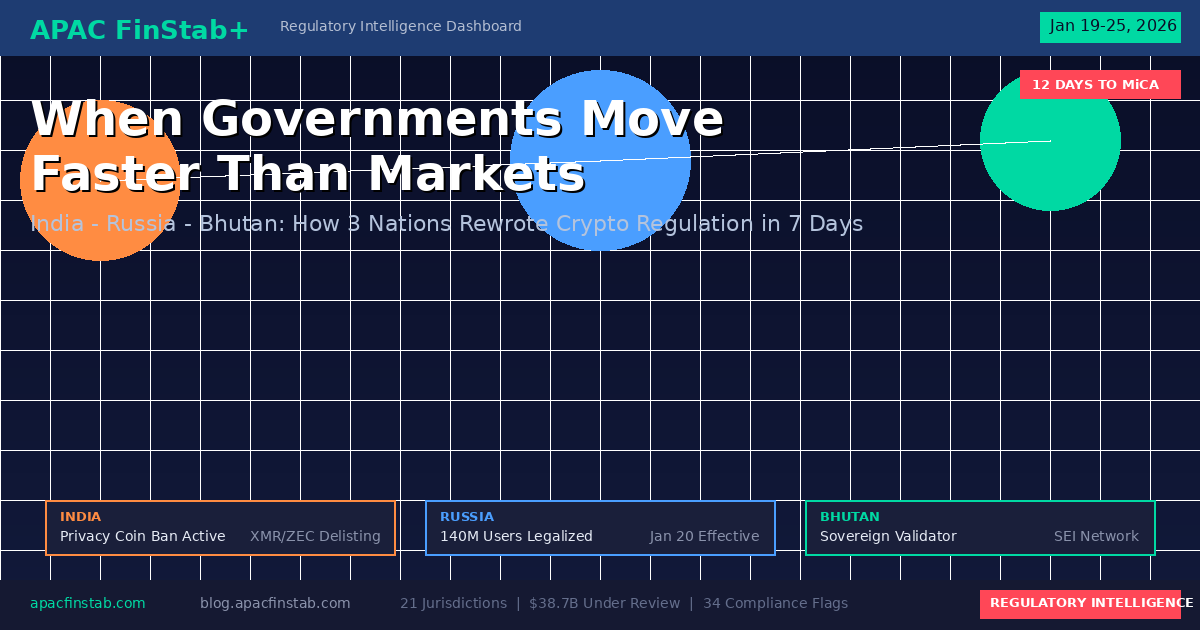

In the past 18 months, we have witnessed unprecedented regulatory acceleration. The U.S. passed the GENIUS Act (stablecoin framework) and the CLARITY Act (digital asset classification). Hong Kong enacted the Stablecoin (FRS) Bill and expanded its VATP licensing regime. Singapore implemented its stablecoin regulatory framework. Japan approved its first yen-backed stablecoin (JPYC) and is preparing a comprehensive crypto bill by 2026. The EU's MiCA framework is now in full effect. Australia, South Korea, and the Philippines are all advancing their own regimes.

A product designed for compliance today may fall into a regulatory gap tomorrow. A distribution strategy optimized for Q4 2025 may become non-compliant by Q2 2026. Regulatory velocity demands not just point-in-time compliance, but trend-aware compliance—the ability to anticipate where the rules are going, not just where they are.

2. The Regulatory Translation API: A Conceptual Framework

We propose treating regulatory compliance as an API—a structured interface that transforms well-defined inputs into actionable outputs. The framework is not a legal opinion; it is a decision-support system that makes regulatory complexity systematically addressable.

2.1 Input Layer: Four Dimensions of Product Design

Product Model: What Is Being Tokenized?

The product model defines the underlying asset and the legal relationship between the token holder and that asset. Key parameters include: asset class (sovereign debt, corporate bonds, real estate, private credit, commodities, equities); asset geography (U.S., EU, APAC, emerging markets); legal structure (direct ownership, SPV-intermediated, trust structure, fund share); redemption mechanism (T+0, T+1, periodic windows, no redemption); and yield structure (pass-through, accumulated, reinvested). A tokenized U.S. Treasury held through a Cayman SPV with daily NAV strikes and T+0 redemption is a fundamentally different product from a tokenized real estate share held through a Delaware LLC with quarterly distributions and 12-month lockup. The product model determines the baseline regulatory classification before any token-specific factors are considered.

Business Model: How Does the Issuer Make Money?

The business model defines the revenue structure and distribution channels. Key parameters include: fee structure (management fees, performance fees, transaction fees, spread capture); distribution channel (direct-to-investor, B2B2C through intermediaries, platform-based); investor base (institutional only, accredited investors, retail eligible); and geographic scope (single jurisdiction, regional, global). A B2B model that white-labels tokenized Treasuries to licensed broker-dealers has different regulatory exposure than a direct-to-retail model that markets tokenized real estate shares to global investors through a mobile app. The business model determines which regulatory touchpoints are activated—securities law, broker-dealer registration, investment adviser requirements, cross-border marketing restrictions.

Token Model: What Are the Economic Rights?

The token model defines the economic and governance rights encoded in the token. Key parameters include: economic rights (pro-rata yield distribution, capital appreciation, liquidation preference); governance rights (voting, information rights, consent rights); transferability (freely transferable, whitelist-restricted, platform-locked); and token standard (ERC-20, ERC-1400, ERC-3643, proprietary). A fungible, freely transferable token with full economic rights but no governance rights is classified differently from a non-transferable token with governance rights but no economic rights. The token model determines whether the asset is "Distributed" (can be transferred P2P, held in self-custody, composed with DeFi protocols) or "Represented" (exists only as platform-internal accounting, cannot be transferred outside the issuing system).

Chain Behavior: What Happens On-Chain?

Chain behavior defines the observable on-chain activities of the token. Key parameters include: deployment chain (Ethereum, Polygon, Solana, permissioned/consortium chains); secondary trading (CEX listing, DEX liquidity pools, OTC only); DeFi integration (collateral in lending protocols, LP in AMMs, structured product components); and cross-chain bridging (native multi-chain deployment, wrapped tokens, bridge protocols). A token deployed on Ethereum with active Uniswap liquidity and Aave collateral integration has dramatically different regulatory exposure than the same token deployed on a permissioned chain with no secondary market. Chain behavior is the dimension that can change dynamically after issuance, making it the primary source of "regulatory drift"—the phenomenon where a compliant product gradually moves into non-compliance through behavioral evolution.

2.2 Output Layer: Six Dimensions of Regulatory Response

Regulatory Classification

For each target jurisdiction, the framework outputs a primary classification and potential alternative classifications. In the U.S., this might be: "Security (Reg D exempt) with potential Money Transmission Act exposure if stablecoin-settled." In Hong Kong: "Complex product requiring PI-only distribution unless SFC approval obtained for retail." In Singapore: "Digital payment token unless pegged to SGD/G10, in which case regulated stablecoin." Classification is not static—it includes trigger conditions that would cause reclassification.

Risk Mapping

The framework maps the product to specific risk categories monitored by regulators: market risk (price volatility, liquidity risk, concentration risk); credit risk (counterparty default, collateral quality, recovery rates); operational risk (custody failure, smart contract bugs, oracle manipulation); AML/CFT risk (transaction monitoring gaps, beneficial ownership opacity, sanctions exposure); and consumer protection risk (disclosure adequacy, suitability, complaint handling). Each risk category is scored based on the four input dimensions, producing a risk profile that can be compared against regulatory risk appetite in each jurisdiction.

Jurisdictional Landing Points

For each jurisdiction, the framework outputs: required licenses (and which entity must hold them); required registrations (securities, commodity derivatives, money transmission); required disclosures (prospectus, offering memorandum, risk factors); required operational controls (custody, valuation, audit, reporting); investor restrictions (accredited only, PI only, retail eligible with conditions); and tax treatment (income vs. capital gains, withholding obligations, reporting requirements). This creates a compliance checklist that is jurisdiction-specific and product-specific.

Compliance Cost Estimation

The framework provides estimated compliance costs: fixed costs (licensing fees, legal setup, initial audits); variable costs (ongoing compliance staff, periodic audits, regulatory reporting); time costs (licensing timeline, product approval timeline); and opportunity costs (restricted distribution channels, reduced investor base, feature limitations). This enables cost-benefit analysis: Is the addressable market in Jurisdiction X worth the compliance cost? Should the product be structured differently to avoid Jurisdiction Y's requirements entirely?

Gray Zone Identification

Gray zones are areas where regulatory guidance is ambiguous, enforcement history is sparse, or classification could go either way. The framework explicitly identifies these zones: "DeFi integration may trigger MiCA's 'crypto-asset service provider' definition—no enforcement precedent yet." "Yield distribution mechanism resembles interest payment—potential bank license trigger in Jurisdiction Z." "Token burn mechanism may constitute redemption offer—securities law implications unclear." Gray zones are not necessarily prohibitive, but they require explicit risk acceptance and mitigation strategies.

Three-Year Trend Forecast

Regulatory compliance is not a snapshot; it is a trajectory. The framework provides trend forecasts: Where is this jurisdiction heading on stablecoin regulation? On security token classification? On DeFi integration rules? On cross-border recognition? These forecasts are informed by: legislative pipeline (bills in progress, regulatory consultations); enforcement patterns (recent actions, stated priorities); international coordination (FATF guidance, FSB recommendations, bilateral agreements); and market evolution (institutional adoption pressure, retail demand, crisis events). A product that is compliant today but trending toward non-compliance may require different strategic decisions than one that is currently in a gray zone but trending toward clarity.

3. Application: Case Studies Across Asset Classes

3.1 Case Study: Tokenized U.S. Treasury Fund

Input Profile:

Product Model: Money market fund holding short-term U.S. Treasuries, NAV-stable ($1.00 target), daily liquidity, T+0 redemption in USDC. Business Model: B2B distribution to licensed broker-dealers and asset managers; 15bps management fee. Token Model: ERC-20 on Ethereum, whitelisted transfers only, full economic rights, no governance. Chain Behavior: Multi-chain deployment (Ethereum, Arbitrum, Solana, Polygon), no DEX listing, collateral-eligible in select DeFi protocols.

Output Profile:

U.S. Classification: Registered investment company (1940 Act fund) or Reg D private placement depending on investor base. Stable NAV may trigger money market fund rules under Rule 2a-7. USDC settlement triggers no additional MSB registration if USDC issuer (Circle) is separately licensed. Hong Kong Classification: SFC-authorized fund if distributed to retail; PI-only distribution otherwise. Complex product designation likely due to DeFi collateral use. VATP license required for any platform offering trading. Singapore Classification: Not a regulated stablecoin (not SGD/G10 pegged). Capital markets product if offered to Singapore investors; prospectus exemption available for institutional sales. MAS digital payment token rules do not apply. Gray Zones: DeFi collateral integration creates potential "crypto-asset service" exposure under evolving EU/HK frameworks. Cross-chain bridging may create custody chain-of-title questions. Three-Year Forecast: Expect harmonization of MMF token rules across US/HK/SG by 2027. DeFi collateral use likely to require explicit regulatory approval rather than current permissionless model.

3.2 Case Study: Tokenized Private Credit

Input Profile:

Product Model: Senior secured loans to mid-market corporates, 9-12% yield, 6-12 month duration, floating rate, Cayman SPV structure. Business Model: Direct-to-investor platform; $100K minimum; 2% management fee + 20% performance fee. Token Model: ERC-1400 security token, transfer restrictions enforced on-chain, economic rights only. Chain Behavior: Ethereum mainnet only, no DEX listing, no DeFi integration, secondary trading on licensed ATS only.

Output Profile:

U.S. Classification: Security under Howey test. Reg D 506(c) exemption for accredited investor sales; Form D filing required. Secondary trading requires ATS registration or exemption. Investment adviser registration likely required for manager. Hong Kong Classification: CIS (collective investment scheme) requiring SFC authorization or professional investor exemption. Type 9 license required for fund management activity. Singapore Classification: CIS requiring MAS authorization or accredited investor exemption. Licensed fund management company required. Risk Mapping: High credit risk (mid-market corporate defaults); operational risk (loan servicing quality, recovery process); liquidity risk (no daily redemption). Gray Zones: Cayman SPV structure may trigger substance requirements under OECD BEPS. Floating rate mechanism creates interest rate derivative exposure in some jurisdictions. Token burn on maturity may constitute redemption offer. Compliance Cost: Estimated $500K-$1M initial setup; $200-400K annual ongoing compliance. 6-12 month licensing timeline in each jurisdiction.

3.3 Case Study: Tokenized Real Estate Revenue Rights

Input Profile:

Product Model: Revenue participation rights in Class A commercial real estate; 4-6% yield from rental income; no equity ownership; Hong Kong property with mainland China tenant base. Business Model: Platform-based retail distribution; HKD 1,000 minimum; 1.5% management fee. Token Model: NFT-style unique tokens representing specific revenue tranches; freely transferable post-KYC; platform-enforced whitelist. Chain Behavior: HashKey Chain (HK-licensed permissioned chain); secondary trading on DigiFT (SFC-licensed platform); no DeFi integration.

Output Profile:

Hong Kong Classification: Likely CIS or SFC-regulated structured product. Retail distribution requires SFC authorization and prospectus. DigiFT listing provides compliant secondary market. Platform chain (HashKey) provides regulatory-aligned infrastructure. Singapore Classification: Revenue participation right may not constitute security; likely unregulated if no Singapore marketing. If Singapore investors targeted, prospectus or exemption required. U.S. Classification: Almost certainly a security under Howey. No retail distribution possible without full SEC registration. Reg S exemption for offshore sales only. Risk Mapping: Real estate market risk; tenant concentration risk; FX risk (HKD/RMB); operational risk (revenue collection, distribution mechanism). Gray Zones: Revenue right vs. security classification in HK still evolving. Cross-border tenant exposure creates mainland regulatory touchpoints. NFT structure may complicate fungibility analysis. Three-Year Forecast: Hong Kong moving toward explicit real estate token framework; expect clarity by 2027. Mainland exposure likely to require additional compliance layer as China develops its own digital asset rules.

4. APAC Regulatory Deep Dive: Nine Markets Compared

The Asia-Pacific region presents the most dynamic regulatory environment for RWA tokenization globally. Unlike the relatively unified approach in the EU (MiCA) or the ongoing legislative process in the U.S., APAC jurisdictions have developed distinct frameworks reflecting their unique financial system structures, policy priorities, and competitive positioning.

4.1 Hong Kong: The Institutional Hub

Hong Kong has positioned itself as the region's institutional RWA hub. The May 2025 Stablecoin (FRS) Bill establishes a licensing regime for fiat-referenced stablecoin issuers, with 100% reserve requirements, monthly attestations, and redemption guarantees. The HKMA's Ensemble project—a sandbox for tokenized assets—has validated the "domestic asset chain + Hong Kong trading chain" architecture that enables mainland Chinese assets to be tokenized for international distribution without data leaving China. Twenty-five institutions participated in Ensemble's first phase, including HSBC, Standard Chartered, Bank of China Hong Kong, and Ant Digital Technologies.

Key regulatory interfaces: SFC for securities/CIS tokens; HKMA for stablecoins and banking integration; VATP licensing for retail trading platforms. Professional investor threshold: HKD 8 million portfolio or equivalent. Retail access: Authorized funds only, with prospectus and risk disclosure requirements. Cross-border: Strong bilateral frameworks with Singapore, UAE; developing framework with mainland China through Greater Bay Area initiatives. Trend forecast: Expect explicit real estate token and private credit token frameworks by 2027; retail access expansion for "simple" RWA products; deeper mainland integration through tokenized cross-border settlement.

4.2 Singapore: The Regulatory Laboratory

Singapore has taken a "sandbox-first" approach, using Project Guardian (with DBS, JPMorgan, and others) to test institutional DeFi and tokenized assets in controlled environments before establishing permanent rules. The August 2023 stablecoin framework applies to single-currency stablecoins pegged to SGD or G10 currencies, with reserve requirements, redemption guarantees, and disclosure obligations. MAS has signaled intent to treat compliant stablecoins as a "digital SGD equivalent" for certain settlement purposes.

Key regulatory interfaces: MAS for all financial services including digital payment tokens, capital markets products, and fund management. Payment Services Act for payment tokens; Securities and Futures Act for security tokens. Accredited investor threshold: SGD 2 million net assets or SGD 300K annual income. Cross-border: Strong framework with Hong Kong, EU; developing recognition with UAE, Japan. Trend forecast: Expect tokenized government securities framework by 2026; wholesale CBDC (Project Orchid) integration with tokenized assets; expansion of stablecoin regime to multi-currency baskets.

4.3 Japan: The Compliance-First Market

Japan's regulatory approach prioritizes consumer protection following the Mt. Gox and Coincheck incidents. The FSA has approved the first yen-backed stablecoin (JPYC), pegged 1:1 to JPY and backed by bank deposits and JGBs. The Electronic Payment Instrument (EPI) regime governs most stablecoins, while security tokens fall under the Financial Instruments and Exchange Act. A comprehensive crypto bill is expected by 2026 that will address DeFi, DAO governance, and cross-border token transfers.

Key regulatory interfaces: FSA for all digital asset activities; JFSA for foreign exchange controls. Platform Progmat (backed by major banks and trust companies) provides the dominant infrastructure for tokenized securities. Investor protections: Strict suitability requirements; leverage limits; cold wallet custody mandates. Trend forecast: Expect security token market to expand significantly as Progmat scales; JPY stablecoin adoption in cross-border settlement; potential for retail RWA access through licensed intermediaries by 2027.

4.4 South Korea: The Post-Crisis Framework

South Korea's regulatory framework is shaped by the Terra/Luna collapse. The Virtual Asset User Protection Act (Phase 1) is in effect, with Phase 2 legislation focused on stablecoins in development. The FSC has taken a cautious approach to algorithmic stablecoins while exploring frameworks for fully-reserved, fiat-backed alternatives. Registered VASPs operate under strict AML/CFT requirements, with withdrawal restrictions and mandatory cold storage.

Key regulatory interfaces: FSC for virtual asset policy; FIU for AML/CFT compliance. No explicit RWA tokenization framework yet; security token issuance possible through existing securities law with sandbox approval. Trend forecast: Expect stablecoin framework by late 2026; gradual opening to institutional RWA products; continued conservative approach to retail crypto exposure.

4.5 Other APAC Markets: Australia, Philippines, UAE, Thailand, Indonesia

Australia's Project Acacia (with the RBA and Digital Finance CRC) is testing 24 RWA tokenization use cases; legislation expected 2026. The Philippines' BSP has launched a peso stablecoin (PHPC) pilot through Coins.ph, testing remittances, exchange, and DeFi use cases. The UAE's DFSA approved the region's first tokenized money market fund in Q3 2025, positioning Dubai as a Gulf RWA hub. Thailand's SEC has authorized several tokenized investment products with retail access through licensed platforms. Indonesia's OJK continues to develop its framework, with a focus on Islamic finance-compliant tokenization structures.

5. Implementation: Building the Translation Layer

The Regulatory Translation API is a conceptual framework, but it can be operationalized. Implementation requires three components: a structured input protocol, a jurisdiction-rule database, and a continuous monitoring system.

5.1 Structured Input Protocol

For each RWA product, create a standardized input document that captures: Product Model (asset class, legal structure, redemption mechanism, yield structure, underlying asset jurisdiction); Business Model (fee structure, distribution channels, target investor segments, geographic scope); Token Model (token standard, economic rights, governance rights, transferability constraints); and Chain Behavior (deployment chains, secondary market plans, DeFi integration plans, cross-chain strategy). This document becomes the "source of truth" that feeds the regulatory analysis. It should be version-controlled, with updates triggered whenever any input dimension changes.

5.2 Jurisdiction-Rule Database

For each target jurisdiction, maintain a structured database of: classification rules (what combination of product/token/chain features triggers which classification); licensing requirements (by classification); disclosure requirements (by classification and distribution channel); operational requirements (custody, valuation, audit, reporting); investor restrictions (thresholds, suitability, disclosure); tax treatment (by token type and investor residence); and enforcement history (precedents, stated priorities, penalty ranges). This database requires continuous maintenance. Regulatory intelligence services, legal counsel, and primary source monitoring should feed updates on at least a weekly basis.

5.3 Continuous Monitoring System

The chain behavior dimension is dynamic—it can change after issuance through market activity, protocol upgrades, or strategic decisions. A monitoring system should track: on-chain activity (trading volumes, wallet distribution, DeFi integration metrics); regulatory developments (new rules, consultation papers, enforcement actions); market structure changes (new platforms, liquidity venue shifts); and product changes (feature additions, chain expansions, investor base evolution). When any monitored parameter crosses a threshold, the system should re-run the regulatory translation to identify potential classification drift or new compliance obligations.

6. Conclusion: From Complexity to Tractability

The tokenization of real-world assets is not a technology problem. The smart contracts work. The chains scale. The assets are real. The institutional demand is proven. The bottleneck is regulatory translation—the ability to systematically map innovative products to evolving multi-jurisdictional frameworks without drowning in complexity or missing critical gray zones.

The Regulatory Translation API framework does not eliminate this complexity. It makes it tractable. By decomposing products into four input dimensions and regulatory responses into six output dimensions, issuers gain a structured methodology for navigating the APAC landscape and beyond. By treating compliance as a continuous process rather than a point-in-time exercise, they can anticipate regulatory drift before it becomes a crisis. By explicitly identifying gray zones, they can make informed risk decisions rather than unknowing bets.

The next three years will see regulatory frameworks mature, harmonize in some areas, and diverge in others. Stablecoin regimes are converging toward common principles (full reserves, redemption rights, disclosure). Security token classification remains divergent and likely to stay so. DeFi integration is the emerging frontier where no jurisdiction has established clear rules and enforcement precedents are sparse. Issuers who build regulatory translation capability today will have a structural advantage as these frameworks evolve.

The winners in RWA tokenization will not be those with the best technology or the most attractive yields. They will be those who can systematically convert regulatory complexity into compliance precision—and who can do so faster, cheaper, and more reliably than their competitors. The Regulatory Translation API is a first step toward that capability.